The ABC Company wishes to borrow $10,000 from the City Bank, repayable in three annual installments (the

Question:

The ABC Company wishes to borrow $10,000 from the City Bank, repayable in three annual installments (the first one due one year from now). If the bank charges 0.10 interest, what will be the annual payments?

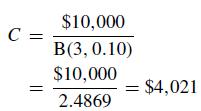

From equation (2.9),

Data from equation (2.9)

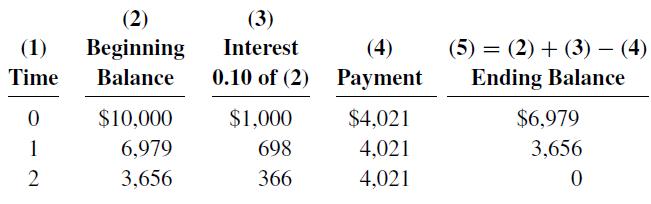

and the loan amortization schedule is

The loan amortization schedule starts with the initial amount owed. Column 3 shows the interest on the amount owed at the beginning of the period (column 2). Column 4 is the payment to pay the debt and column 5 shows the ending debt The loan amortization schedule starts with the initial amount owed. Column 3 shows the interest on the amount owed at the beginning of the period (column 2). Column 4 is the payment to pay the debt and column 5 shows the ending debt balance. The ending debt balance is equal to the beginning debt balance plus the period’s interest less the debt payment.

The process is repeated for the life of the debt. If the present value of the debt payments is equal to the initial beginning balance (as it will be using the effective cost of debt to compute the present value), the ending balance after the last debt payment will be equal to zero.

Step by Step Answer:

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman