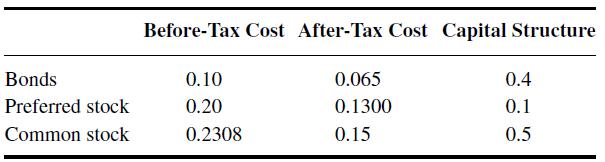

The tax rate for the Gas Corporation is 0.35. The following table has been prepared for the

Question:

The tax rate for the Gas Corporation is 0.35. The following table has been prepared for the president of the firm.

a. Compute the weighted average after-tax cost of capital of the firm, with the given capital structure.

b. Compute the return before tax for an investor who splits the investment in the company in the same proportion as the sources of capital.

c. If $1,000 of each type of capital were raised, the capital would have to earn before tax:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: