In Example 24.2, what is the tranche spread for the (6 %) to (9 %) tranche? Data

Question:

In Example 24.2, what is the tranche spread for the \(6 \%\) to \(9 \%\) tranche?

Data from Example 24.2

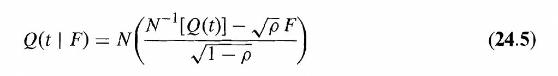

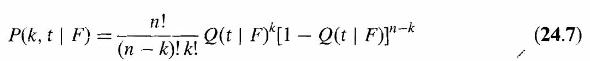

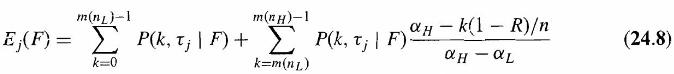

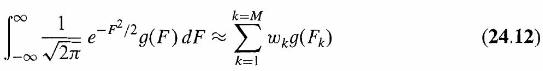

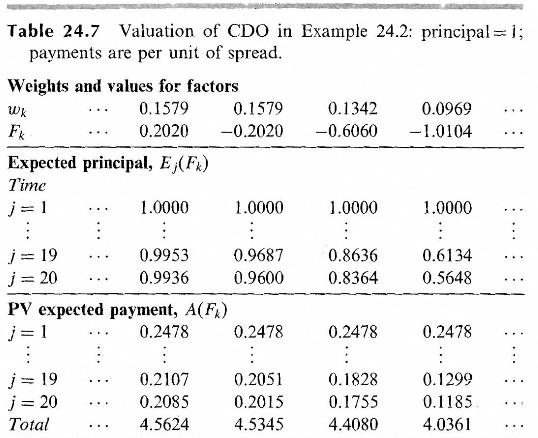

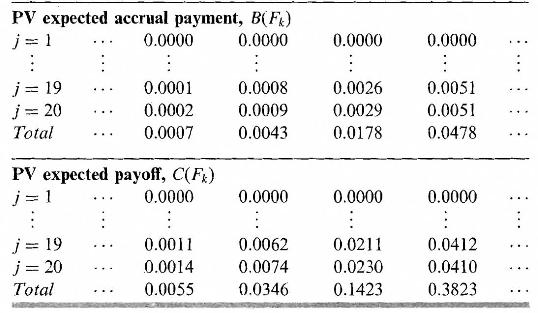

Consider the mezzanine tranche of iTraxx Europe (5-year maturity) when the copula correlation is 0.15 and the recovery rate is \(40 \%\). In this case, \(\alpha_{L}=0.03, \alpha_{H}=0.06\), \(n=125, n_{L}=6.25\), and \(n_{H}=12.5\). We suppose that the term structure of interest rates is flat at \(3.5 \%\), payments are made quarterly, and the CDS spread on the index is 50 basis points. A calculation similar to that in Section 24.2 shows that the constant hazard rate corresponding to the CDS spread is \(0.83 \%\) (with continuous compounding). An extract from the remaining calculations is shown in Table 24.7. A value of \(M=60\) is used in equation (24.12). The factor values, \(F_{k}\), and their weights, \(w_{k}\), are shown in first segment of the table. The expected tranche principals on payment dates conditional on the factor values are calculated from equations (24.5) to (24.8)

Step by Step Answer: