Tia has called a team meeting to discuss how the testing over Crest Outfitters web sales went

Question:

Tia has called a team meeting to discuss how the testing over Crest Outfitters’ web sales went and to talk about gathering substantive evidence on the remainder of the financial statements. This week the team will focus on asset and liability accounts. Based on the analysis of the financial statements, the most significant accounts based on size are cash; trade receivables; inventory; property, plant and equipment; trade payables and unearned revenue.

Tia has asked the team to brainstorm and discuss what key factors will come into play when designing the substantive audit programs for each of these accounts. Which accounts hold higher levels of inherent risk? What tests could the auditors conduct to investigate whether those risks have resulted in a material misstatement? Tia asks the team members to provide her with information about their availability over the coming weeks because some of the audit procedures they will need to conduct are time specific. Leigh asks, ‘What do you mean by time-specific? Don’t we just look at documents and paperwork? Shouldn’t they be available any time?’

Rory jumps in to explain. ‘To test some assertions, like the existence of inventory, we typically attend stocktakes on the year-end date. This is because it’s more efficient to test existence of inventory on the year-end date — this gives us the most accurate and reliable evidence. We might not always do this because of scheduling and other factors, but testing closer to the year-end date is always preferable.’

Leigh realises that thinking about when evidence must be collected is just as important as thinking about what to collect (via which specific audit procedure) and how much (based on their sampling decisions).

SUBSTANTIVE TESTING OF SPECIFIC ACCOUNTS

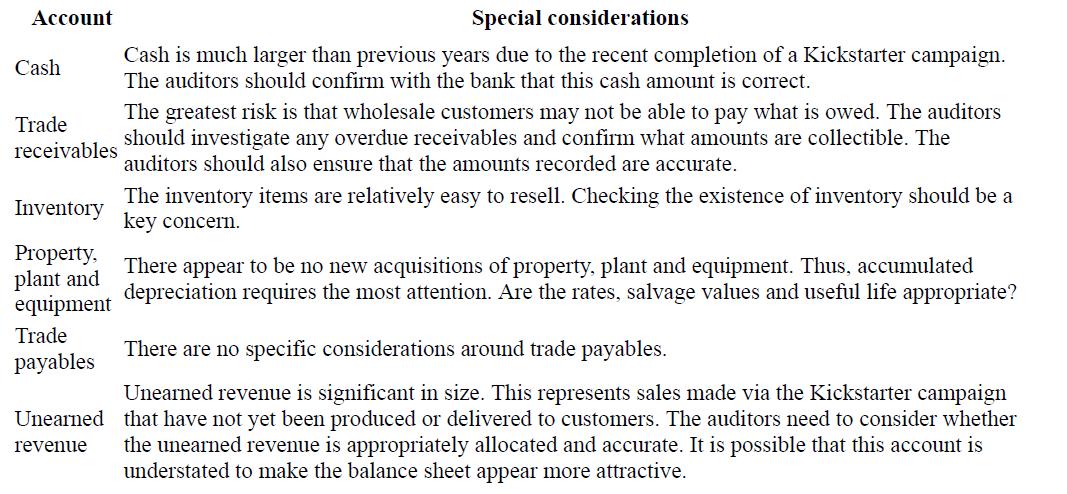

Rory and Leigh are to report back to Tia about any specific considerations they have around substantively testing the balance sheet. They prepare the following table in advance.

Required

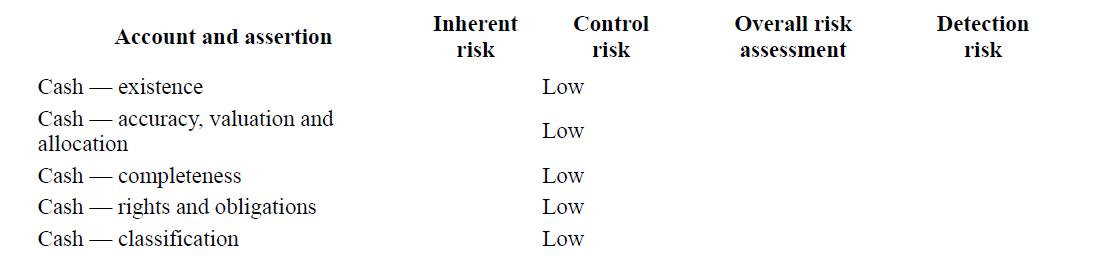

Tia has asked Rory and Leigh to begin planning the testing of the cash account. Complete the following table based on your understanding of Crest Outfitters and the information contained in the table that Rory and Leigh prepared for Tia. Rory has filled in the level of control risk based on other work he has completed.

After completing this table, design a substantive audit program to gather evidence on the cash account. Remember that when designing audit procedures, you should refer to the appropriate audit procedure and include sufficient detail so that a fellow audit team member could follow your instructions. You may need to include instructions related to sampling, such as the population that you choose your sample from, the size and scope of the testing and the samples selected.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 9780730382645

4th Edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton