Brown, CPA, received a telephone call from Calhoun, the sole owner and manager of a small corporation.

Question:

Brown, CPA, received a telephone call from Calhoun, the sole owner and manager of a small corporation. Calhoun asked Brown to prepare the financial statements for the corporation and told Brown that the statements were needed in two weeks for external financing purposes. Calhoun was vague when Brown inquired about the intended use of the statements. Brown was convinced that Calhoun thought Brown's work would constitute an audit. To avoid confusion Brown decided not to explain to Calhoun that the engagement would only be to prepare the financial statements. Brown, with the understanding that a substantial fee would be paid if the work were completed in two weeks, accepted the engagement and started the work at once.

During the course of the work, Brown discovered an accrued expense account labeled "professional fees" and learned that the balance in the account represented an accrual for the cost of Brown's services. Brown suggested to Calhoun's bookkeeper that the account name be changed to "fees for limited audit engagement." Brown also reviewed several invoices to determine whether accounts were being properly classified. Some of the invoices were missing. Brown listed the missing invoice numbers in the working papers with a note indicating that there should be a follow-up on the next engagement. Brown also discovered that the available records included the fixed asset values at estimated current replacement costs. Based on the records available, Brown prepared a balance sheet, income statement and statement of stockholder's equity. In addition, Brown drafted the footnotes but decided that any mention of the replacement costs would only mislead the readers. Brown suggested to Calhoun that readers of the financial statements would be better informed if they received a separate letter from Calhoun explaining the meaning and effect of the estimated replacement costs of the fixed assets. Brown mailed the financial statements and footnotes to Calhoun with the following note included on each page:

The accompanying financial statements are submitted to you without complete audit verification.

{Required:}

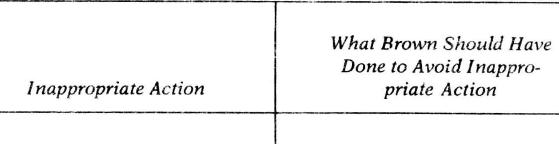

Identify the inappropriate actions of Brown and indicate what Brown should have done to avoid each inappropriate action. Organize your answer sheet as follows:

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler