The Patricia Company had poor internal control over its cash transactions. Facts about its cash position at

Question:

The Patricia Company had poor internal control over its cash transactions. Facts about its cash position at November 30, 19X0 were as follows:

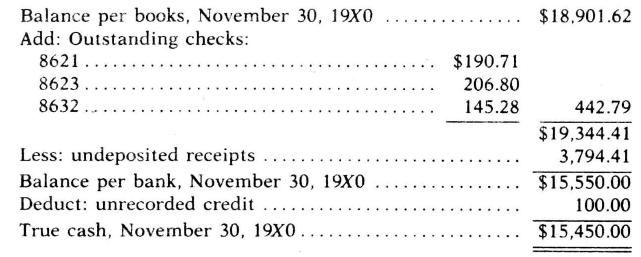

The cashbooks showed a balance of \(\$ 18,901.62\), which included undeposited receipts. A credit of \(\$ 100\) on the bank's records did not appear on the books of the company. The balance per bank statement was \(\$ 15,550\). Outstanding checks were: \(\# 62\) for \(\$ 116.25, \# 183\) for \(\$ 150, \# 284\) for \(\$ 253.25, \# 8621\) for \(\$ 190.71, \# 8623\) for \(\$ 206.80\), and \#8632 for \(\$ 145.28\).

The cashier abstracted all undeposited receipts in excess of \(\$ 3,794.41\) and prepared the following reconciliation:

Balance per books, November 30, 19X0 .............. \(\$ 18,901.62\)

Add: Outstanding checks:

Required:

a. Prepare a working paper showing how much the cashier abstracted.

b. How did he attempt to conceal his theft?

c. Using only the information given, name two specific features of internal control which were apparently lacking.

Step by Step Answer:

Modern Auditing

ISBN: 9780471542834

5th Edition

Authors: Walter Gerry Kell, William C. Boynton, Richard E. Ziegler