Question: You are asked by your supervisor to design and execute an attribute sampling plan pertaining to the proper execution of cash receipts transactions in the

You are asked by your supervisor to design and execute an attribute sampling plan pertaining to the proper execution of cash receipts transactions in the Christy Company. You decide that the following attributes should be tested:

1. Remittance advices and checks agree with prelist.

2. Cash register readings agree with amounts on cash count sheets.

3. Daily cash summary agrees with combined totals of prelists and cash count sheets.

4. Daily cash summary agrees with duplicate deposit slip.

5. Duplicate deposit slip agrees with amount on bank statement.

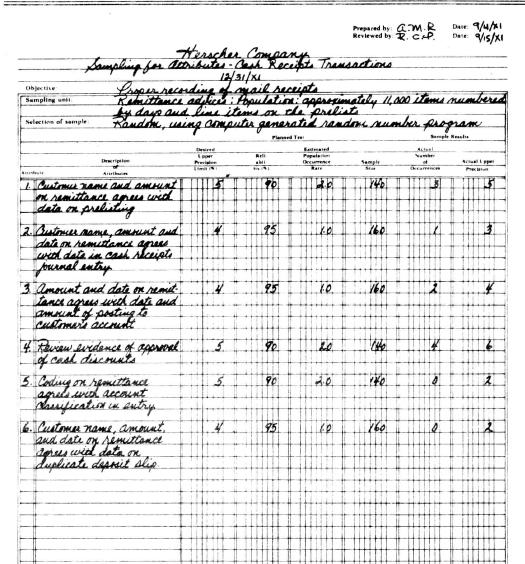

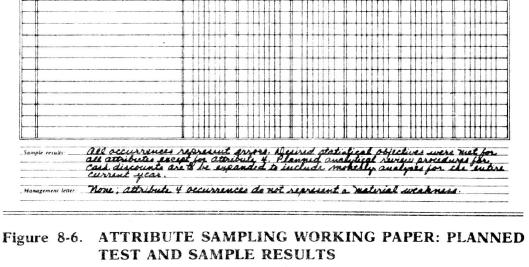

Assume your planned statistical objectives are the same as shown for the first five attributes of Figure 8-6 except that you desire 95 percent reliability for each attribute and that the maximum expected population occurrence rate is 1.5 percent. Assume that your sample results are the same as in Figure 8-6 except that the actual occurrences for attributes 2 and 3 are 2 and 4 , respectively.

\section*{Required:}

a. Present in schedule form similar to Figure \(8-6\) the planned test and sample results for each attribute.

b. Comment on the results of your test.

Figure 8-6

Prepared by am.R Reviewed by R. CAP. Date: 9/4/41 Dane 15/X1 Objective Sampling unt Selection of sample Herscher Company Sampling for attributes: Cash Receipts Transactions 12/31/1 Iroper recording of mail receipts Remittance adplices: Population: approximately 11,000 items numbered by days and line items on the prelist Random, using computer generated random number program 1. Customus name and amount on remittance agrees wid date on prelisting 2. Customer name, amount and date on remittance agrees with date in cash receipts Journal entry 3 amount and date on remit tance agrees with date and amount of 4. Review evidence of approval. of cash discounts 3. Coding on remittance agrees with account Sherification in entry. 6. Customer name, amount. and date on remittance agrees wid data on duplicate deposit slip 70 Sample 24 25 1.0 160 95 1.0. 80 90 20 2 ind 95 60 160 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts