You have recently been appointed auditor of DonkeyAid, a small, registered charity which raises funds to rescue

Question:

You have recently been appointed auditor of DonkeyAid, a small, registered charity which raises funds to rescue distressed donkeys. The charity makes payments to individuals who adopt rescued donkeys so they can provide suitable accommodation and to meet initial vet's fees, etc. The charity is run by a voluntary management committee, which has monthly meetings and employs the following full-time staff:

(a) A director, Mrs Wimble, who is responsible for fund raising and who makes payments to individuals and implements policies adopted by the management committee and

(b) A secretary (and book-keeper), Ms Khan, who deals with correspondence and keeps the accounting records.

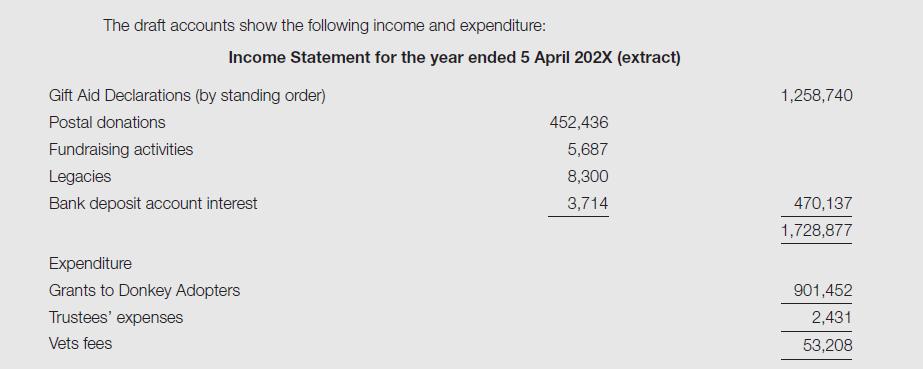

You are planning the audit of the charity for the year ended 5 April 202X and are considering the evidence you will need to verify income and expenditure.

Notes:

(a) Gift Aid Declarations are completed by each person who intends to make contributions during the year.

These are paid directly into the charity's bank account on a monthly basis by standing order. Gift Aid Declaration forms are kept by Ms Khan. (Gift Aid Declarations are used in the UK. Tax on these payments can be reclaimed but this should be ignored for the purposes of this question.)

(b) Postal donations, which can be cash or cheques, are dealt with by Ms Khan who prepares a daily list of donations. She also updates the cash book and prepares the bank paying-in slip.

(c) Fundraising activities include street collections and an Autumn Fair. This is a major event and takes place every year on a Saturday in October. Supporters of the charity provide items to sell or auction, and a charge is made for entrance and refreshments are sold. Mrs Wimble collects the takings, prepares a summary of receipts and banks them the following Monday.

(d) Legacies are received irregularly and usually sent to the director of the charity, who gives them to Ms Khan for banking.

(e) Bank deposit interest is paid gross by the bank, as DonkeyAid is a charity.

Required:

You are required to gather sufficient, reliable evidence to validate that the income or expenses shown above is fairly stated. For each individual item of income and expense shown above list the type of evidence you would consider could provide the evidence you need.

Step by Step Answer: