During 1984-85, the credit union industry in Australia considered various ways of improving the electronic funds transfer

Question:

During 1984-85, the credit union industry in Australia considered various ways of improving the electronic funds transfer services that it offered to its members. Most credit unions already provided automatic teller machines (ATMs) for their members to use. The ATMs were connected only to the local mainframe machine, however, at the credit union's head office. Thus, members could transact business only at an ATM owned by their credit union. If a member traveled elsewhere within Australia, therefore, credit union services were limited.

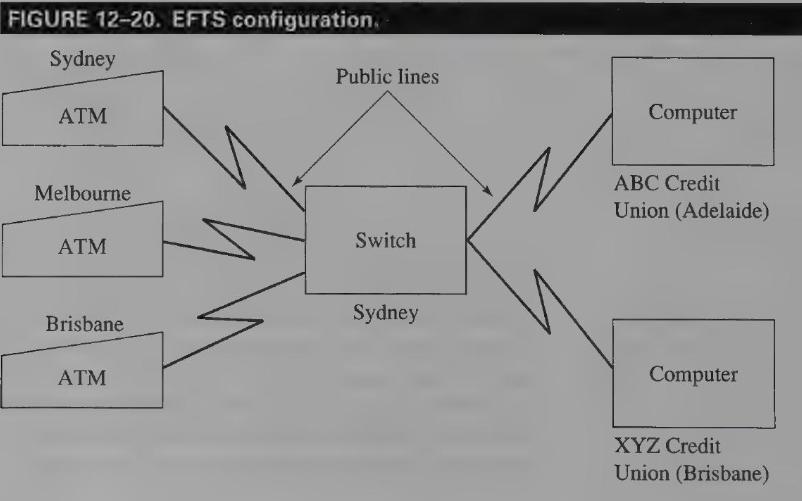

In an attempt to remedy this situation, many credit unions decided to connect their ATMs to a public electronic funds transfer network. In addition, they agreed to share ATM facilities throughout Australia. In principle, therefore, a member could go to any ATM in Australia owned by a credit union, use their membership card to gain access to the ATM, and carry out deposit or withdrawal transactions. Because the ATM was controlled by the public electronic funds transfer system, a switch in the system would identify the credit union to which the member belonged and route the transaction to the member's own credit union computer for approval and processing. Although the topology of the public electronic funds transfer network changed from time to time in light of cost-benefit considerations, Figure 12-20 shows one configuration that was used.

To illustrate processing, assume that you belonged to the \(\mathrm{XYZ}\) credit union in Brisbane. If you wanted money while you were visiting Sydney, you would go to any ATM connected to the credit union network. Using your membership card, you would activate the ATM, enter your PIN, and then key in a withdrawal transaction. The ATM would then send the transaction to a switch in the public electronic funds transfer network which, in turn, would route the transaction to the XYZ credit union computer in Brisbane for approval and processing. The XYZ credit union computer would identify and authenticate you, examine whether you had sufficient funds in your account to cover the withdrawal amount, and send a message back to the switch either approving or denying withdrawal of the funds. The switch would then send a message to the ATM that you had used to initiate the transaction.

Required: Identify four exposures that arise as a result of the shared ATM configuration. Identify some controls that you believe should be present to reduce expected losses from these exposures to an acceptable level. Note, do not list exposures that existed before the use of the shared ATM configuration.

Step by Step Answer: