The Altman Z-score predicts bankruptcy using commonly available financial accounting information (e.g., EBIT and total assets). Suppose

Question:

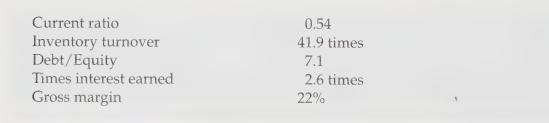

The Altman Z-score predicts bankruptcy using commonly available financial accounting information (e.g., EBIT and total assets). Suppose you are studying a company (whose primary business is produce wholesaling) for purposes of making the going concern determination and its Altman Z-score comes to 2.68, indicating that there is not an immediate threat of bankruptcy but that they deserve watching. Further suppose that the ratio analysis of the company yields the following:

Finally, suppose that you know the following about the company:

- Although its bank requires them to pay off their line of credit for at least 30 days per year, it frequently does so only by extending its trade payables significantly.

- Its suppliers (e.g., the farmers) are beginning to favor marketing their crops through a nonprofit co-op.

- Management has been in the fruit and vegetable business for many years but no plans for an orderly management succession have been made.

- A major competitor just installed an inventory control system that makes extensive use of bar-coding. As a result, the competitor's losses on spoilage have decreased significantly.

- Due solely to poor weather, operating margins have been squeezed between farmers demanding more for their crops and the company's customers' ability to obtain supplies from foreign sources.

Although the picture looks bleak for your client, discuss several mitigating factors that, if present, would likely moderate any inkling you may have to give the company a modified audit report with a going concern qualification. What would be the likely affect of an unfavorable going concern opinion on its ability to operate?

Step by Step Answer:

Auditing Assurance And Risk

ISBN: 9780324313185

3rd Edition

Authors: W. Robert Knechel, Steve Salterio, Brian Ballou