The New Hong Kong Chinese Banking Corporation (NHKCBC) is a large Hong Kong-based bank that offers a

Question:

The New Hong Kong Chinese Banking Corporation (NHKCBC) is a large Hong Kong-based bank that offers a wide range of retail and wholesale banking services. Retail customers can access services in four ways: over the counter (COUNTERbank); via automatic teller machines (ATMbank); via telephone (PHONEbank); and via personal computers (PCbank).

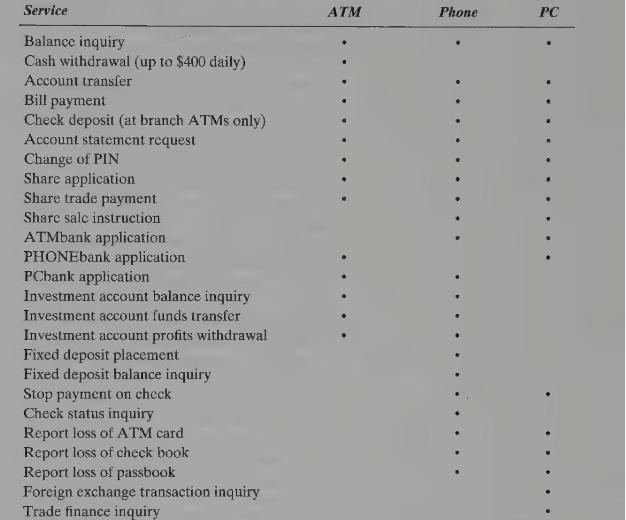

The following table summarizes the services that retail customers can access via ATMbank, PHONEbank, and PCbank:

In a fiercely competitive market, \(\mathrm{NHKCBC}\) is constantly updating its services to retail customers. In this light, during the past year the bank's internal auditors have installed ITF as a concurrent auditing technique to monitor the modification and maintenance work that is frequently carried out to the ATMbank, PHONEbank, and PCbank systems.

As the manager in charge of the external audit for NHKCBC this financial year, you are currently planning the substantive tests to be undertaken in relation to the ATMbank, PHONEbank, and PCbank systems. The bank is an aggressive competitor, and thus you have judged the inherent risk associated with the bank to be moderate to high. On the basis of the audit evidence collected so far, however, you judge the control risk associated with the ATMbank, PHONEbank, and PCbank systems to be low to moderate. You note that the internal auditors should have already carried out substantive testing of the systems using ITF. In this light, you conclude that you can reduce the extent of substantive testing carried out by your own staff if you can place reliance on the substantive testing carried out by the internal audit staff.

Required: The budget for the audit of NHKCBC is tight, and significant cost overruns have already occurred. Accordingly, which of the retail bank transaction types in the table would be your primary focus when you examine the use of ITF by NHKCBC's internal auditors? Briefly explain why you would seek evidence on how well the internal auditors have used ITF to test these transaction types. Also, briefly outline the criteria you would use to determine how well the internal auditors have used ITF to carry out their testing.

Step by Step Answer: