You are the senior auditor in charge of the December 31, 2018, year-end audit for Cleo Patrick

Question:

You are the senior auditor in charge of the December 31, 2018, year-end audit for Cleo Patrick Cosmetics Inc. (CPCI). CPCI is a large, privately held Canadian company that was founded in 1999 by one of Canada?s best known hair stylists, Cleo Patrick. Cleo Patrick is a famous celebrity hair stylist who has appeared on a variety of television shows such as Entertainment Tonight, and has been the chief stylist for the Oscars and Emmys. The company includes (1) a small chain of 10 upscale salons situated in major cities in Canada and the United States and (2) its well-known signature line of professional hair products that are available at select drug stores and retail chains. The core of its business is its signature hair products line, Cleo Patrick True Professional. The True Professional line represents 85 percent of the company?s total revenue. During the planning phase of the audit, you performed various planning activities and met with CPCI?s management team. You obtained the following information.

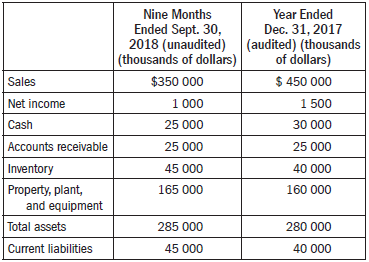

1. Your firm has audited CPCI since 2005, when Cleo sold 25 percent of her company to a group of private investors.The investors receive quarterly dividends that are calculated based upon a combination of sales and net income. The investors, all experienced businesspeople, serve as Cleo?s board of directors and give her advice on the strategic direction of the company.2. Your firm has not had any major disputes with CPCI management over accounting issues; however, last year it recommended that CPCI improve the organization of its accounting department?which is understaffed.3. High-priced mass-market hair products represent a highly competitive supersaturated market. Large multinationals make up about 70 percent of the market, with niche companies such as CPCI making up the remaining 30 percent. Management does not consider multinationals to be a threat: ?Unlike our competitors, we are a true salon heritage brand backed by an active celebrity stylist.?4. From your review of the 2017 audited financial statements and the 2018 third quarter unaudited financial statements, you noted the following information:

5. Cleo plans to expand into Europe and is negotiating contracts with drug stores in the United Kingdom and Germany. In order to fund this expansion, CPCI?s bank has agreed to increase CPCI?s operating line of credit. As part of the agreement, CPCI is required to maintain a minimum quick ratio of 1:2 and a positive net income. ?In addition, CPCI is required to provide the bank with audited financial statements.6. Your firm has an employee who reads and saves articles about issues that may affect key clients. You read an article that says that two of CPCI?s top-selling products recently made ?The Dirty Dozen? list. Thelist, developed by an environmental research foundation, highlights those cosmetic products that have toxic chemicals (some of which are cancer-causing). CPCI claims that all its products are safe and meet theprovincial and federal health and safety guidelines. You discuss the issue with CPCI management and find out that it is working on reformulating both products, which should be ready in 2019. CPCI is offering large rebates to retailers in order to encourage sales of its older products. The two ?dirty? products currently make up about 20 percent of CPCI?s current inventory of $45 million.

7. William Kirk was hired recently as the chief operating officer (COO) to provide closer oversight of the company. Due to all the new products and expansions, Cleo does not have time to spend monitoring the daily operations. Kirk is attempting to bring in a greater emphasis on controls around financial reporting and monitoring (as recommended by your firm in the past). Kirk started in June 2018 and one of the first things he did was to replace the chief financial officer (CFO), who was not very organized and tended to delay handling problems.Kirk also implemented a new bonus plan based upon sales growth and profitability targets. He told you he thinks it is working out really well and sales are growing.However, Kirk has not had a chance to implement all his plans?such as hiring additional accounting staff and performing a formal assessment of the quality of internal controls.8. In early 2018, CPCI launched two new collections, Ultimate Moisture and Moisture Gloss. These two products placed an extensive strain on the company?s cash flow. CPCI had spent $15 million in product development and $10 million on advertising. However, sales were much lower than predicted. Management had anticipated 2018 sales for the two products to be $9 million to $10 million. However, as of October 2018, actual sales were only $2 million. When you inquired about the low sales, the new CFO explained that the buyer had purchased inappropriate raw materials. This was not discovered during the inspection process when the materials were received. As a result, the finished product did not meet quality standards and was destroyed, and the new product arrived in stores much later than planned. The CFO stated that the salespeople were working really hard at trying to get product demand back on track by year-end and were offering new contracts, with very favourable terms, to potential customers.

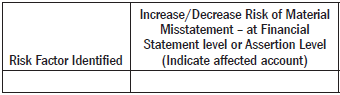

REQUIREDa. Based on the above information, identify factors that affect the risk of material misstatement in the December 31, 2018, financial statements of CPCI. Indicate whether the factor increases or decreases the risk of material misstatement at the financial statement level or the assertion level.

b. Make an acceptable audit risk decision for the current year as high, medium, or low, and support your answer.c. Make a preliminary judgment of overall materiality for the CPCI audit, show your calculations, and provide your rationale for choice of benchmark and percentage.d. What would you set performance materiality to be?Explain why.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Auditing The Art and Science of Assurance Engagements

ISBN: 978-0134613116

14th Canadian edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Joanne C. Jones