The Harley-Davidson Motor Company (Harley-Davidson) began over 100 years ago, fulfilling a dream of 21-year-old William S.

Question:

The Harley-Davidson Motor Company (Harley-Davidson) began over 100 years ago, fulfilling a dream of 21-year-old William S. Harley and 20-year-old Arthur Davidson. In 1903, they made available to the public the first Harley-Davidson motorcycle, a bike built to be a racer. The factory in which they worked was a 10- by 15-feet wooden shed with the words “Harley-Davidson Motor Company” scrawled on the door. Arthur’s brother Walter later joined their efforts.

Over one-hundred years later, Harley-Davidson’s total assets and net sales have each grown to over $5 billion, with annual production of over 330,000 motorcycles and a 49% share of the U.S. heavyweight motorcycle market with 31 domestic models included in its 2008 model year.

The Milwaukee-based company has an avid following of motorcycle enthusiasts. The Harley-Davidson Owners Group, frequently referred to as “H.O.G.,” is the largest factory-sponsored motorcycle club in the world, with over one million members worldwide. In 2002, FORBES summarized the tremendous success of Harley-Davidson as follows:

"In a disastrous year for hundreds of companies, Harley's estimated 2001 sales grew 15%, to $3.3 billion, and its earnings grew 26%, to $435 million. Its shares were up 40% in 2001, while the S&P dropped 15%. Recessions don't phase this profit machine.

Harley grew right through the last one, too. Infact, since Harley's initial public offering in 1986, the company has put up 37% average annual earnings growth. Investors who went looking for tech sizzle and cover-boy chief executives would have done better with hogs. Since Harley went public, its shares have risen 15,000%. Intel? A mere 7,200% since 1986. GE? A paltry 1,056%."1 HARLEY-DAVIDSONS eBUSINESS SUPPLY CHAIN In the mid-1990s, Harley-Davidson faced the enormous challenge of meeting production demand for its motorcycles. Like many companies in today s global marketplace, Harley-Davidson struggled to manage all of its upstream suppliers (who provide raw materials) to ensure the effective downstream manufacture and delivery of motorcycles to customers. Company leaders found that managing complex supply-chains, which involve material and information flows concerning new product development, systems management, operations and assembly, production scheduling, order processing, inventory management, transportation, warehousing and customer service, presents numerous challenges for large manufacturing organizations like Harley-Davidson.

Harley-Davidson attacked the supply-chain problem by streamlining its cumbersome and bureaucratic supply-chain into a vertically and technologically integrated system ofsuppliers directly interested in Harley-Davidson’s success. To assist with the transformation, Harley-Davidson’s Vice President of Materials Management, Garry Berryman, initiated a consolidation of Harley- Davidson’s supply-chain to overhaul this vital aspect of company management. His plan involved a company-wide consolidation of its various purchasing departments, the formation of new business partnerships, and several technological innovations.

Consistent with other companies with complex supply-chain systems, Harley-Davidson faced huge hurdles associated with coordinating a large number of material requirements and suppliers. To effectively implement its internal supply chain makeover, Harley-Davidson had to radically alter its corporate purchasing philosophy and move to a more centralized purchasing process. Prior to initiating the overhaul, Harley-Davidson had nine purchasing systems, over 4,000 separate suppliers, and little or no central guidance for purchasing. The company consolidated its purchasing function by forming a select group of suppliers from its enormous supply chain and ultimately cut its supplier base by 80%, from 4,000 to 800.

In addition to consolidating its purchasing function, Harley-Davidson also worked hard to foster new business partnerships with these key suppliers. Bringing the suppliers into strategic partnerships with Harley-Davidson was difficult. Management had to show its business partners that being selected as a key supplier for a company like Harley-Davidson would have a tremendous positive impact. Then, the company had to convince suppliers to agree to certain conditions associated with its offer. For example, Georgia Pacific’s Unisource division had to commit to doubling quality, cutting product development time in half, and lowering the cost of goods in order to meet Harley-Davidson’s requirements for inclusion in its supply chain. Fortunately, Unisource recognized the potential payoff. Unisource’s revenues increased over ten times as a result of being selected as a key Harley-Davidson supplier.

Once suppliers were integrated into Harley-Davidson’s supply chain, the company faced another problem: how to effectively and seamlessly share information with its new network of suppliers ? Harley-Davidson turned to the Internet as the solution for integrating its supplier network. Use of the Internet enabled smaller suppliers, previously unable to connect to the company’s legacy electronic data interface (EDI) systems, to participate in the supply-chain process. The versatility of the Internet provided an interface for transactions and interactions with the majority of its suppliers, removing costly hurdles imposed by the restrictive technology compatibility requirements of its old EDI systems.2 To provide the technological interface for communicating with its suppliers, Harley-Davidson selected Manugistics Group, Inc. to power the Harley-Davidson Supplier Network that provides real-time access to detailed order and inventory data. Manugistics is one of the leading suppliers of Enterprise Profit Optimization (EPO) services. These services use information technology (IT) innovations to allow companies and their suppliers to lower operating costs by simultaneously improving supply-chain management and supplier relationship management.3.........

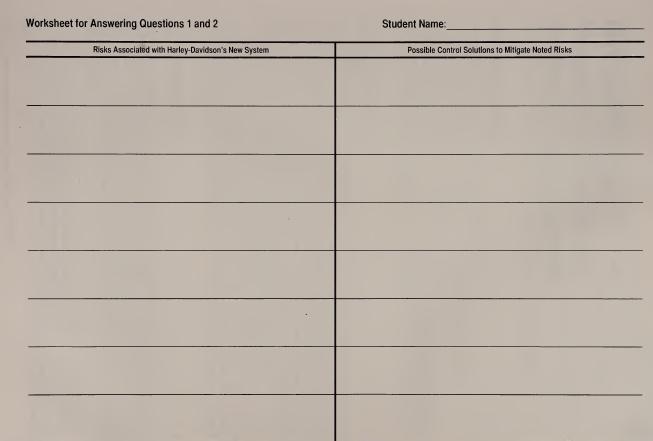

REQUIRED [1] Identify the most significant new business risks facing Harley-Davidson as a result of integrating eBusiness into its supply-chain management system and by allowing suppliers to have access to the company’s Intranet. If your instructor does not specify the number of risks for you to identify, list at least three.

[2] For each risk you identified in question number one above, identify a control Harley-Davidson might have implemented to mitigate that risk.

Note: Your instructor may request that you prepare your answers to questions 1 and 2 using the worksheet on the next page.

[3] Given the technology linkages between business partners in eBusiness systems, how might an eBusiness system like Harley-Davidson’s increase business risks for its business partners?

[4] Research the SysTrust and WebTrust services from the information on the following web page (or search the Internet or within the AICPA’s Information Technology Center Web site for “Trust Services’): http://infotech.aicpa.org. Describe how WebTrust services differ from SysTrust services. Describe how they are related.

[5] What Trust Services Principles are examined in a SysTrust engagement? Describe the role of the criteria when evaluating these principles in a SysTrust engagement.

[6] According to the AICPAWeb site indicated in question number four, what professional standards must a CPA follow when providing assurance services that result in the expression of a WebTrust or SysTrust opinion?

[7] Assume Harley-Davidson asks your CPA firm about the WebTrust and SysTrust services that it provides. Write a brief memo to Gerry Berryman, Vice president of Materials Management, detailing the potential benefits of WebTrust and SysTrust for Harley-Davidson. Include in the memo a recommendation regarding which ofthese assurance services would be most appropriate for Harley-Davidson’s supply chain management system. Be sure to explain to Mr. Berryman the nature of the two different services and why you are recommending the one you chose.

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 978-0132423502

4th Edition

Authors: Steven M Glover, Douglas F Prawitt