Members of a single family own the majority of the capital stock of Custom Furniture Company, a

Question:

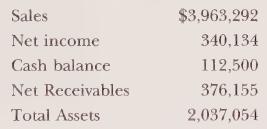

Members of a single family own the majority of the capital stock of Custom Furniture Company, a small corporation not listed on any stock exchange. The balance of the capital stock is held by a few outside investors. Custom Furniture Company sells a limited variety of household furnishings such as chairs, tables, and desks. The majority stockholders are not actively involved in the management of the company. but the minority stockholders try to "keep a close eye" on management's performance, especially profits. Several minority stockholders have tried to sell their stock. but were unable to do so at the price they wanted. A few of them blame poor management performance for subpar financial statement results. Custom Furniture has a group of approximately 100 customers that order the same type of merchandise each month. Each of them orders the same quantity and in approximately the same time frame. The minority stockholders have tried to persuade the Board of Direc- tors to broaden their customer base and even branch out into other product lines. So far, their efforts have not been successful because of the conservative policies of the majority stockholders. A slow but sustained economic recovery has been underway for the past two to three years. Custom Furniture Company is benefiting from increased orders by the select group of reliable customers. Custom Furniture Company has 60 full- and part-time employees, including manufactur- ing, sales, and clerical personnel. The Board of Directors, reflecting the attitude of the majority stockholders, has little knowledge of the system that produces the financial statements. Some minority stockholders know enough accounting to make a reasonable analysis of financial statement results, but their lack of knowledge of accounting makes them feel somewhat ignorant about "where the numbers really came from." The Board has consistently refused to hire a CPA firm to perform a financial audit, believing that the close holding of their stock and a personal relationship with their bankers negates any need to have an audit. The minority stockholders disagree, but are always outvoted at meetings of the Board. Here are some key figures from the unaudited financial statements as of the last full year of operations, October 31, 19X7.

The majority stockholders are satisfied with these amounts and the financial statement results in general. Some minority stockholders believe that the amounts are inflated, al- though they cannot furnish any proof because the controller and other members of management do not confide in them. Some of the minority stockholders believe that "economic reality" will deflate the amounts sooner or later, forcing them to sell their stock to the majority stockholders at significantly reduced prices.

Required:

Write a short memo (two pages or less) answering the following questions:

a. Give reasons why the Board should hire a CPA firm to perform a financial statement audit. Where applicable, refer to specific paragraphs of the above narrative to support your views.

b. Give reasons why the Board should not hire a CPA firm to perform a financial statement audit. Where applicable, refer to specific paragraphs of the above narrative to support your views.

c. What parts of the company's activities might be examined in an operational audit? Why? (Make reasonable assumptions about the company's operations.)

d. In what way might stewardship or agency theory play a role in a decision to have a financial statement audit? Where applicable, refer to specific paragraphs in the above narrative.

e. Under what limitations might the auditors be working if a financial statement audit were performed? Where applicable, refer to specific paragraphs in the above narrative.

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor