Potential conflicts of interest and other ethical matters were resolved between Custom Furniture Company and Ms. Hunt,

Question:

Potential conflicts of interest and other ethical matters were resolved between Custom Furniture Company and Ms. Hunt, and she began the audit. The loan officer of the bank was notified and told that the bank would receive a copy of the audited financial statements and Ms. Hunt's opinion as soon as the audit was completed. No copy of the letter to the loan officer was given to Ms. Hunt, and no one at Custom Furniture Company was sure that Ms. Hunt knew the specific bank that would receive the audit report.

The audit proceeded smoothly for the first three weeks. Ms. Hunt's brother-in-law continued to act as mail clerk, and there was very little contact between the two. The major conflict between Ms. Hunt and Custom Furniture Company occurred when receivables were examined for proper valuation. Custom Furniture Company had insisted that gross profits from large installment sales be shown as current revenues, with only a small allowance for doubuful accounts provided in the balance sheet. Ms. Hunt was willing to show these gross profits as current revenues only if a substantial allowance for doubfful accounts was recorded in valuing net receivables.

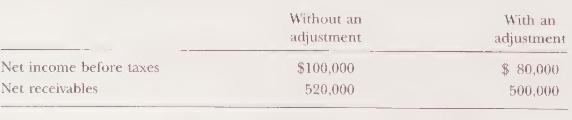

The financial statement results both with and without an adjustment for uncollectible installment sales are shown below.

The conversations became so contentious that Ms. Hunt discontinued the audit for several days. The controller of Custom Furniture Company contended that the loan would be jeopardized by a sharply reduced net income that was too far below what they had told the bank the company would earn. The controller strongly hinted that the company's inability to secure the loan might create problems in paying the audit fee. Ms. Hunt, visibly shaken by this veiled threat, decided to discuss it with her partner who would bear joint responsibility for signing the audit report.

Ms. Hunt's partner insisted that the threat to withhold the audit fee was a form of blackmail that they must not tolerate. He had never been strongly in favor of accepting the audit, and he suggested that a prudent course of action was to resign from the audit and "cut our losses."

Ms. Hunt initially agreed with her partner, but after some reflection believed the relationship could be repaired and the audit completed, at least for that year. She doubled the scope of her audit procedures on net accounts receivable, examining practically every credit file that looked doubtful of collection. By the time she finished these procedures, the budgeted time on the audit had already been exceeded. More discouraging was the resistance she continued to receive when she showed the credit manager evidence of poor collectibility for many of the installment sales. She offered to lower the proposed adjustment by 25 percent, but the controller refused to adjust the books for any more allowance for doubtful accounts than he had previously provided.

A few days later, the controller brought in a large check from one of the installment sales previously regarded as uncollectible. Ms. Hunt was so happy about this turn of events that she accepted the check as legitimate and failed to substantiate its legitimacy. She made some calculations and concluded that she could live with the allowance for doubtful accounts currently on the books.

Later in her office, Ms. Hunt called her partner and gave him the happy news. But her worksheet calculations did not impress her partner, who continued to insist that the unadjusted allowance would make the financial statements materially misstated. After considerable discussion, Ms. Hunt reluctantly concluded that even such a large and unexpected collection would not alter the need for several thousand dollars of adjustment to net receivables.

The next day, both Ms. Hunt and her partner had a lengthy meeting with several of Custom Furniture Company's top officials, including the controller and credit manager. When the meeting ended, everyone agreed that the audit engagement was over and that the appropriate report would be sent from Ms. Hunt to Custom Furniture Company. The loan was turned down by the bank, and Custom Furniture Company contracted its operations.

Required:

a. Write a memo describing the auditors' legal exposure if they had accepted the unadjusted financial statements. Indicate in the memo what legal relationship the court might determine and what standard of proof the court might require.

b. What were the "hero's" reasons for rejecting Ms. Hunt's argument to leave the net receivables unadjusted?

Step by Step Answer:

Auditing An Assertions Approach

ISBN: 9780471134213

7th Edition

Authors: G. William Glezen, Donald H. Taylor