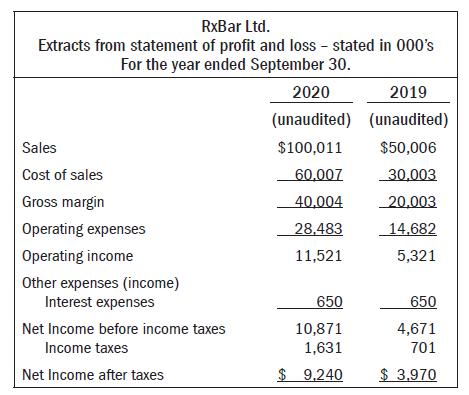

Refer to Question 8-4 for background on the company. Below is an excerpt of the preliminary financial

Question:

Refer to Question 8-4 for background on the company. Below is an excerpt of the preliminary financial statements and some excerpts from the audit working papers prepared by Shelly, the audit senior.

Data from in question 8-4

Frequently, management is more concerned about internal controls that promote operational efficiency than about those that result in reliable financial data. How can the independent auditor persuade management to devote more attention to controls affecting the reliability of accounting information when management has this attitude?

EVALUATION OF REVENUE CONTROLS

Given the importance of revenue growth, Susan maintains tight control over credit policy. For all new customers, Susan performs an extensive credit check. She requires that the new customers provide three references including their bank. Each reference is emailed and the prospective new client’s credit history is evaluated. For public companies, she also reviews the financial statements and evaluates the company’s liquidity. For international clients outside of Canada and United States, Susan obtains credit risk insurance from Export Development Canada (EDC). The insurance covers up to 90 percent of the losses related to the sale. Susan prepares a monthly summary of new customers and an analysis of aging of accounts receivable. Peter and Ralph have complete trust in Susan and do not see the need to review any of the credit reports or the accounts receivable aging. Based upon my review of the new customer reports, I noted that all had the appropriate documentation with the exception of 10 of the international customers, who did not have EDC insurance. Susan explained that she had been away for three weeks and because she is the only one with authority to obtain the insurance, it was missed. It was noted that all customers were in good standing and therefore the control was effective.

PRELIMINARY ANALYTICAL REVIEW

Inventory has gone up by 113 percent The main reasons for the increase are 1) increased sales levels and 2) one of the purchasing agents had ordered dates way in excess of the production needs. The dates have a three-month shelf life and RxBar is unable to return the product. Accounts receivable have increased 300 percent. The main reasons for the increases are 1) increased sales levels and 2) a change in credit terms from 30 days to 45 days for international customers. Susan explained that this increase was necessary to entice international customers to try their product. Because RxBar has EDC insurance for international customers, there was no need to increase the allowance for doubtful accounts.

REQUIRED

a. In Shelly’s risk assessment of control activities in the revenue cycle, she concluded that the controls over credit policy were effective, do you agree with this conclusion? Why or why not? Do you think she had sufficient and appropriate evidence to make this conclusion? Why or why not?

b. Refer to the analytical review performed in the audit strategy memo. For the analytical review procedures identify the relevant assertion(s), and based on the case facts, indicate whether the misstatement would be an overstatement or understatement and explain the impact on the audit and what additional testing should be done.

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones