You are the audit senior responsible for preliminary planning of E2BHi Inc. for the year ended December

Question:

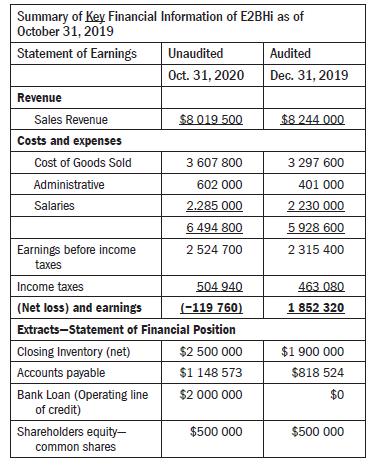

You are the audit senior responsible for preliminary planning of E2BHi Inc. for the year ended December 31, 2020. E2BHi Inc., located in Mississauga Ontario, manufactures and distributes edible cannabis. This is the second year your firm has audited the company. You have just returned from at the company’s head office and have reviewed the prior- year working papers. Below is the information you have compiled to date: The company makes and sells a high-quality baked goods, brownie mixes, beverages, cooking oil, and treats such as mints and gummies that provide the desired effects of cannabis. The company is owned 60 percent by Lisa Fox and the remaining 40 percent was owned by her mother, Judy, who provided Lisa money to start the business. Judy was totally hands-off from E2BHi and let Lisa make all operating decisions. To fund her retirement, Lisa’s mother recently sold her stake in E2BHi to a private equity firm. In addition to its manufacturing facility, E2BHi Inc. operates two retail stores in Hamilton, Ontario, where it sells its products. Edible cannabis products have a short lifespan, which ranges from six to nine months, after that time, the products lose almost all of their potency and must be discarded. E2BHi makes all of its products with only imported cannabis purchased from CouldTrust Inc. an organic cannabis grower located in Jamaica. CouldTrust is known around the world as supplier of high-quality and potency organic cannabis. Over the last year, E2BHi has experienced increased competition from other edible cannabis manufacturers in Ontario who offer cheaper edible products made with Ontario grown cannabis. Ontario grown cannabis is considered to be less potent, is not organic, and is considered to be of poorer quality than cannabis grown in Jamaica and sold by CouldTrust. To start her business Lisa obtained a 10-year loan from the Bank of Newfoundland to purchase required manufacturing equipment. The loan has covenant including a current ratio and a debt-to-equity ratio and requires the audited financial statements to be provided within three months of year-end. A breach of the covenants means that the bank loan will become payable on demand. Lisa does not have sufficient cash flows to repay the loan if the bank were to demand repayment. In addition to its own edible cannabis products, E2BHi also has two retail stores that sell edible cannabis for pets, such as edible cannabis dog and cat treats, which are manufactured by a small local company in London, Ontario, called HiPet. In return for a set amount of shelf space in its two stores, E2BHi gets a commission of 25 percent on the sale of HiPet products. HiPet retains all risks associated with its products, and it must take back any products not sold within six months of delivery. Consumable weed edibles are absorbed through the digestive system, which means the “high” effect may take hours to set in and the potency of effects gradually increases. The onset of effects may occur as quickly as 20 minutes or as slowly as three hours, and the duration can last between four and six hours. In June 2020, four university students who were unaware of this fact, consumed too many E2BHi gummies at once, suffered severe overdose symptoms and had to be hospitalized for several days. A parent of one of the students who sustained permanent damage from the overdose has sued E2BHi. No amount has been accrued in the balance sheet for the possible losses from the lawsuit. Traditionally, Lisa has been paying herself through a combination of dividends and salary. However last year she decided not to declare her usual $100 000 of total dividends. Instead she used the money to rent a large warehouse and begun growing cannabis plants. E2BHi is now starting to use its own grown cannabis in its edible products instead of the more expensive Jamaican imported cannabis. Lisa hopes this will allow E2BHi to lower its prices and respond to the competition. Only companies that hold a Health of Canada licence can grow cannabis in Ontario. About nine months after starting to grow its cannabis, E2BHi finally applied for Health Canada licence. However, at as of October 31, 2020, its licence application has not yet been approved. To remain competitive, this year E2BHi also started price-matching on some products with its local Ontario competitors. Lisa feels that if she does not match the local competitors’ prices, her customers will switch to other edible cannabis brands and shop elsewhere. E2BHi’s controller resigned at the end of January 2020 to take another job. With no controller, most accounting tasks have been delegated to Lisa’s daughter, Jenny, who recently finished her first accounting course. While touring the area where manufacturing takes place, the plant manager, Bob, informed you that he is surprised that customers are sometimes willing to pay three times the price of non-organic cannabis, for organic cannabis edibles. As you were touring the area you noticed a number of storage bins stacked beside the wall, labelled “cannabis pesticide, use protective equipment when handling.” However, all of the edible products you observed, even those E2BHi made with its own newly grown cannabis, are being labelled and sold as “organic.”

REQUIRED

a. Determine planning materiality and performance materiality. Ensure to explain the rationale and support your analysis with calculations.

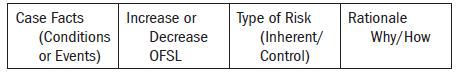

b. Identify five case facts that impact the risk of material misstatement (inherent risks or control risks) at the overall financial statement level (OFSL). For each factor identified, indicate if the factor increases or decreases risk, the type of risk (inherent or control) and provide your rationale for why/how the factor increases or decreases risk. Use the chart below:

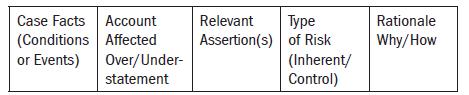

c. Identify four case facts that increase the risk of material misstatement at the assertion level. For each case fact identified indicate the account balance affected and the direction of the misstatement (over or understated) and relevant assertion(s), the type of risk (inherent or control) affected, and provide your rationale.

Step by Step Answer:

Auditing The Art And Science Of Assurance Engagements

ISBN: 9780136692089

15th Canadian Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan, Joanne C. Jones