Question: Exercise 6.1 Suppose that = {1, 2}, n = 2, and T = 1. As the security price processes, we assume that S0(0) =

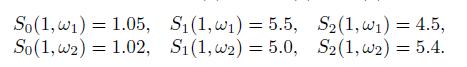

Exercise 6.1 Suppose that Ω = {ω1, ω2}, n = 2, and T = 1. As the security price processes, we assume that S0(0) = 1, S1(0) = S2(0) = 5 and

The securities pay no dividends. Denoting any self-financing portfolio by (θ0, θ1, θ2)⊤, calculate the value process {V (t); t = 0, 1} for each ωi, i = 1, 2.

Verify that (6.9) holds for each state.

So(1, 1) = 1.05, So (1, 2) = 1.02, S(1, w) = 5.5, S(1, w2) = 5.0, S2 (1, w) = 4.5, S2 (1, w2) = 5.4.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts