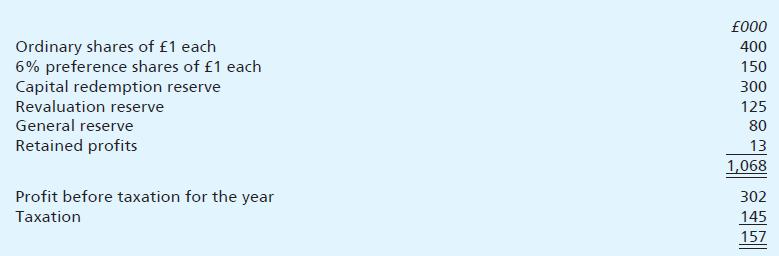

An extract from the draft financial statements of Either Ltd at 30 November 2018 shows the following

Question:

An extract from the draft financial statements of Either Ltd at 30 November 2018 shows the following figures before allowing for any dividend which might be proposed:

Additional information:

(i) The revaluation reserve consists of an increase in the value of freehold property following a valuation in 2016. The property concerned was one of three freehold properties owned by the company and was subsequently sold at the revalued amount.

(ii) It has been found that a number of inventory items have been included at cost price, but were being sold after the date of the statement of financial position at prices well below cost. To allow for this, inventory at 30 November 2018 would need to be reduced by £35,000.

(iii) Provision for directors’ remuneration should be made in the sum of £43,000.

(iv) Included on the statement of financial position is £250,000 of research and development expenditure carried forward.

(v) No dividends have yet been paid on either ordinary or preference shares for the year to 30 November 2018, but the directors wish to pay the maximum permissible dividends for the year.

(vi) Since the draft financial statements were produced it has been reported that a major customer of Either Ltd has gone into liquidation and is unlikely to be able to pay more than 50p in the £ to its creditors. At 30 November 2018 this customer owed £60,000 and this has since risen to £180,000.

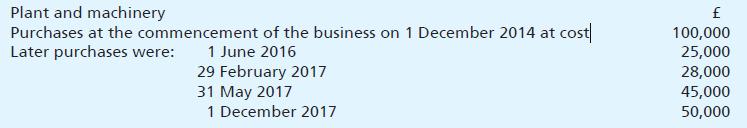

(vii) It has been decided that the depreciation rates for plant and machinery are too low but the effect of the new rates has not been taken into account in constructing the draft financial statements.

The following information is available:

In the draft financial statements depreciation has been charged at the rate of 25% using the reducing balance method and charging a full year’s depreciation in the year of purchase. It has been decided to change to the straight line method using the same percentage but charging only an appropriate portion of the depreciation in the year of purchase. There have been no sales of plant and machinery during the period.

Required:

(a) Calculate the maximum amount which the directors of Either Ltd may propose as a dividend to be paid to the ordinary shareholders whilst observing the requirements of the Companies Acts.

Show all workings and state any assumptions made.

(b) Outline and discuss any differences which might have been made to your answer to (a) if the company were a public limited company.

For the purposes of this question you may take it that corporation tax is levied at the rate of 50%.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster