Fresno Group plc have prepared their financial statements for the year ended 31 January 20X4. However, the

Question:

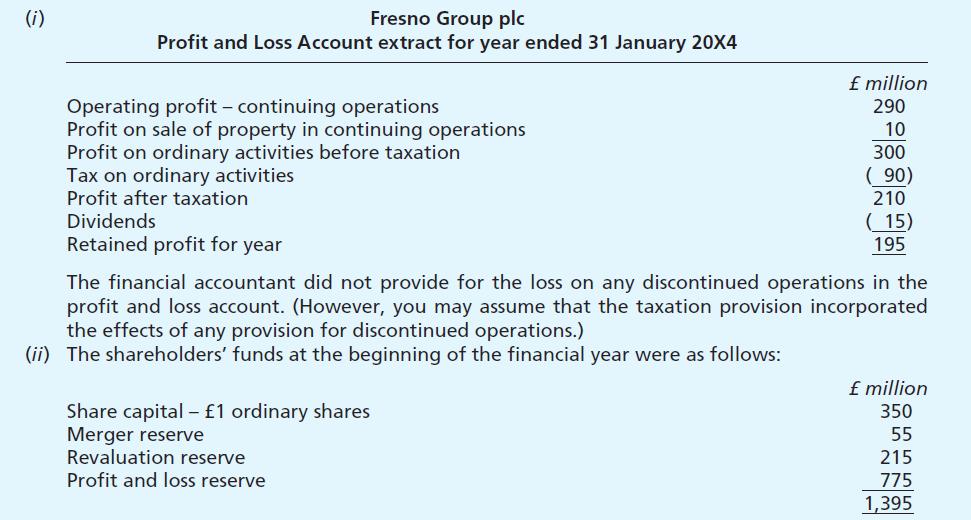

Fresno Group plc have prepared their financial statements for the year ended 31 January 20X4. However, the financial accountant of Fresno Group plc had difficulty in preparing the statements required by FRS 3: Reporting financial performance, and approached you for help in preparing those statements. The financial accountant furnished you with the following information:

(iii) Fresno Group plc regularly revalues its fixed assets and at 31 January 20X4, a revaluation surplus of £375 million had been credited to revaluation reserve. During the financial year, a property had been sold on which a revaluation surplus of £54 million had been credited to reserves. Further, if the company had charged depreciation on a historical cost basis rather than the revalued amounts, the depreciation charge in the profit and loss account for fixed assets would have been £7 million. The current year’s charge for depreciation was £16 million.

(iv) The group has a policy of writing off goodwill on the acquisition of subsidiaries directly against a merger reserve. The goodwill for the period amounted to £250 million. In order to facilitate the purchase of subsidiaries, the company had issued £1 ordinary shares of nominal value £150 million and share premium of £450 million. The premium had been taken to the merger reserve. All subsidiaries are currently 100 per cent owned by the group.

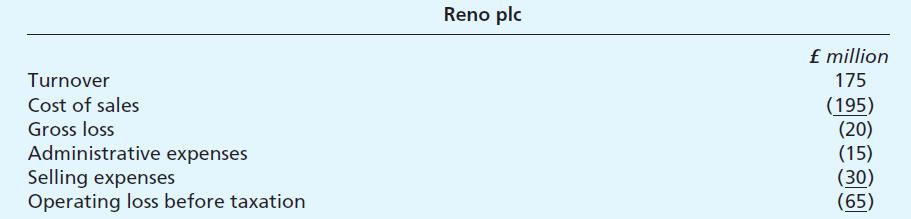

(v) During the financial year to 31 January 20X4, the company had made a decision to close a 100 per cent owned subsidiary, Reno plc. However, the closure did not take place until May 20X4. Fresno Group plc estimated that as at 31 January 20X4 the operating loss for the period 1 February 20X4 to 31 May 20X4 would be £30 million and that in addition redundancy costs, stock and plant write-downs would amount to £15 million. In the event, the operating loss for the period 1 February 20X4 to 31 May 20X4 was £65 million, but the redundancy costs, stock and plant write-downs only amounted to £12 million.

(vi) The following information relates to Reno plc for the period 1 February 20X4 to 31 May 20X4.

Required:

(a) Prepare the following statements in accordance with current statutory requirements and FRS 3: Reporting financial performance for Fresno Group plc for the year ending 31 January 20X4:

(i) Statement of total recognised gains and losses;

(ii) Reconciliation of movements in shareholders’ funds;

(iii) Analysis of movements on reserves;

(iv) Note of historical cost profits and losses.

(b) Explain to the financial accountant:

(i) How the decision to close the subsidiary, Reno plc, affects the financial statements of Fresno Group plc for the year ended 31 January 20X4;

(ii) How the subsidiary, Reno plc, should be dealt with in the financial statements of Fresno Group plc for the year ended 31 January 20X5.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster