M Limited has an authorised share capital of 1,500,000 divided into 1,500,000 ordinary shares of 1 each.

Question:

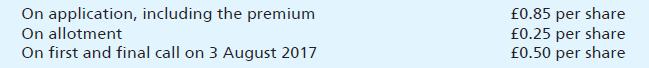

M Limited has an authorised share capital of £1,500,000 divided into 1,500,000 ordinary shares of £1 each. The issued share capital at 31 March 2017 was £500,000 which was fully paid, and had been issued at par. On 1 April 2017, the directors, in accordance with the company’s Articles, decided to increase the share capital of the company by offering a further 500,000 ordinary shares of £1 each at a price of £1.60 per share, payable as follows:

On 13 April 2017, applications had been received for 750,000 shares and it was decided to allot the shares to applicants for 625,000 shares, on the basis of four shares for every five shares for which applications had been received. The balance of the money received on application was to be applied to the amounts due on allotment. The shares were allotted on 1 May 2017, the unsuccessful applicants being repaid their cash on this date. The balance of the allotment money was received in full by 15 May 2017.

With the exception of one member who failed to pay the call on the 5,000 shares allotted to him, the remainder of the call was paid in full within two weeks of the call being made.

The directors resolved to forfeit these shares on 1 September 2017, after giving the required notice.

The forfeited shares were reissued on 30 September 2017 to another member at £0.90 per share.

You are required to write up the ledger accounts necessary to record these transactions in the books of M Limited.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster