Mary Smith commenced trading on 1 September 20X9 as a distributor of the Straight Cut garden lawn

Question:

Mary Smith commenced trading on 1 September 20X9 as a distributor of the Straight Cut garden lawn mower, a relatively new product which is now becoming increasingly popular. Upon commencing trading, Mary Smith transferred £7,000 from her personal savings to open a business bank account.

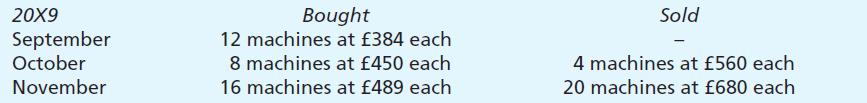

Mary Smith’s purchases and sales of the Straight Cut garden lawn mower during the three months ended 30 November 20X9 are as follows:

Assume all purchases are made in the first half of the month and all sales are in the second half of the month.

At the end of October 20X9, Mary Smith decided to take one Straight Cut garden lawn mower out of stock for cutting the lawn outside her showroom. It is estimated that this lawn mower will be used in Mary Smith’s business for 8 years and have a nil estimated residual value. Mary Smith wishes to use the straight line basis of depreciation.

Additional information:

1. Overhead expenses paid during the three months ended 30 November 20X9 amounted to £1,520.

2. There were no amounts prepaid on 30 November 20X9, but sales commissions payable of 21/2% of the gross profit on sales were accrued due on 30 November 20X9.

3. Upon commencing trading, Mary Smith resigned a business appointment with a salary of £15,000 per annum.

4. Mary Smith is able to obtain interest of 10% per annum on her personal savings.

5. One of the lawn mowers not sold on 30 November 20X9 has been damaged in the showroom and is to be repaired in December 20X9 at a cost of £50 before being sold for an expected £400.

Required:

(a) Prepare, in as much detail as possible, Mary Smith’s trading and profit and loss account for the quarter ended 30 November 20X9 using:

(i) The first in first out basis of stock valuation, and

(ii) The last in first out basis of stock valuation.

(b) Using the results in (a) (i) above, prepare a statement comparing Mary Smith’s income for the quarter ended 30 November 20X9 with that for the quarter ended 31 August 20X9.

(c) Give one advantage and one disadvantage of each of the bases of stock valuations used in (a) above.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster