Nion is a retail goods outlet operating from a head office in London and a branch in

Question:

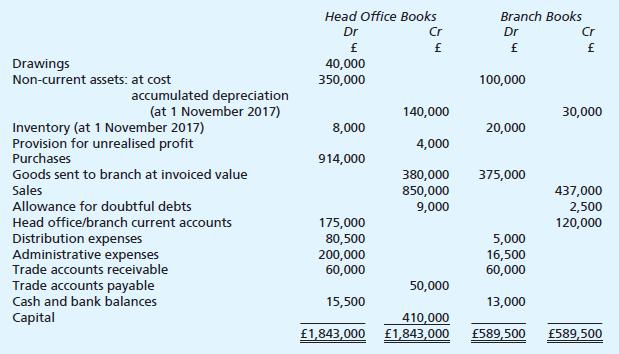

Nion is a retail goods outlet operating from a head office in London and a branch in Brighton. The following trial balances have been extracted from the books of account as at 31 October 2018.

Additional information:

1 All goods are purchased by the head office. Those goods sent to the branch are invoiced at cost plus 25%.

2 Inventories were valued at 31 October 2018 as being at head office, £12,000; and at the branch, £15,000 at their invoiced price.

3 Depreciation is to be provided for the year on the non-current assets at a rate of 10% on the historic cost.

4 The allowance for doubtful debts is to be maintained at a rate of 5% of outstanding trade debtors as at the end of the financial year.

5 As at 31 October 2018, there was £50,000 cash in transit from the branch to the head office; this cash was received in London on 3 November 2018. There was also £5,000 of goods in transit at invoice price from the head office to the branch; the branch received these goods on 10 November 2018.

Required:

Prepare in adjacent columns: (a) the head office, and (b) the branch statements of profit or loss for the year ending 31 October 2018; and a combined statement of financial position for Nion as at that date.

(i) A combined statement of profit or loss is NOT required; and

(ii) Separate statements of financial position for the head office and the branch are also NOT required.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster