Reid and Benson are in partnership as lecturers and tutors. Interest is to be allowed on capital

Question:

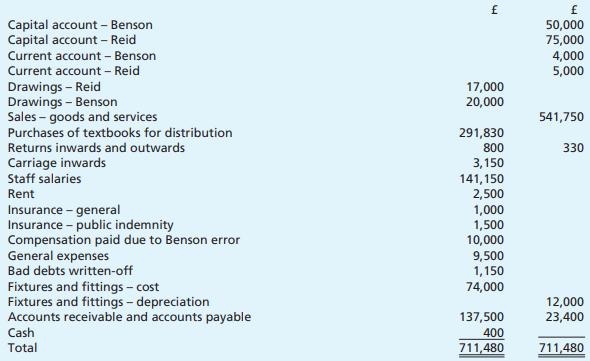

Reid and Benson are in partnership as lecturers and tutors. Interest is to be allowed on capital and on the opening balances on the current accounts at a rate of 5% per annum and Reid is to be given a salary of £18,000 per annum. Interest is to be charged on drawings at 5% per annum (see notes below) and the profits and losses are to be shared Reid 60% and Benson 40%. The following trial balance was extracted from the books of the partnership at 31 December 2014.

l An allowance for doubtful debts is to be created of £1,500. l Insurances paid in advance at 31 December 2013 were General £50; Professional Indemnity £100. l Fixtures and fittings are to be depreciated at 10% on cost. l Interest on drawings: Benson £550, Reid £1,050. l Inventory of books at 31 December 2014 was £1,500. Required: Prepare an income statement together with an appropriation account at 31 December 2014 together with a statement of financial position as at that date.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan