The following trial balance has been extracted from the books of Gain and Main as at 31

Question:

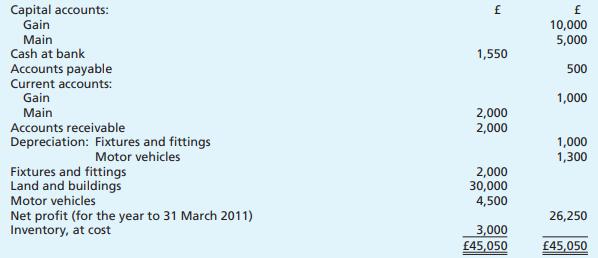

The following trial balance has been extracted from the books of Gain and Main as at 31 March 2011; Gain and Main are in partnership sharing profits and losses in the ratio 3 to 2:

In appropriating the net profit for the year, it has been agreed that Main should be entitled to a salary of £9,750. Each partner is also entitled to interest on his opening capital account balance at the rate of 10 per cent per annum. Gain and Main have decided to convert the partnership into a limited company, Plain Limited, as from 1 April 2011. The company is to take over all the assets and liabilities of the partnership, except that Gain is to retain for his personal use one of the motor vehicles at an agreed transfer price of £1,000. The purchase consideration will consist of 40,000 ordinary shares of £1 each in Plain Limited, to be divided between the partners in profit-sharing ratio. Any balance on the partners’ current accounts is to be settled in cash. You are required to: Prepare the main ledger accounts of the partnership in order to close off the books as at 31 March 2011.

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan