The accounts of an investment firm have been classified into 143 large accounts, 4,780 medium sized accounts,

Question:

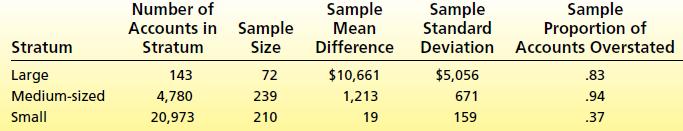

The accounts of an investment firm have been classified into 143 large accounts, 4,780 medium sized accounts, and 20,973 small accounts. The investment firm provides an auditor with each account’s book value. This is the amount of money that the firm claims is in the account. The auditor determines an account’s audit value by contacting the owner of the account. This is the amount of money that is actually in the account. The auditor wishes to detect discrepancies between the stated book values and the audit values. Because it is time consuming and expensive to obtain the audit values, a stratified random sample of accounts is selected, and the difference between the book value and the audit value is determined for each sampled account. The following results are obtained.

a. Find point estimates of and 95 percent confidence intervals for the true total, t, and the true mean, m, of the differences between the book values and the audit values for the population of all of the investment firm’s accounts.

b. Find point estimates of and 95 percent confidence intervals for the true total number, t, and the true proportion, p, of overstated accounts among all of the investment firm’s accounts.

c. What do you conclude? Why was stratified random sampling important in this situation?

Step by Step Answer:

Business Statistics In Practice

ISBN: 9780077534844

7th Edition

Authors: Bruce Bowerman, Richard OConnell, Emilly Murphree