Question: The spreadsheet for this problem provides key facts and assumptions concerning Montego Company, a producer of recreational equipment. It is available for download from McGraw-Hills

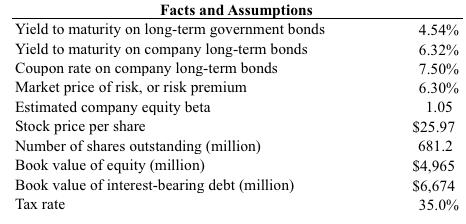

The spreadsheet for this problem provides key facts and assumptions concerning Montego Company, a producer of recreational equipment. It is available for download from McGraw-Hill’s Connect or your course instructor (see the Preface for more information). Using this information:

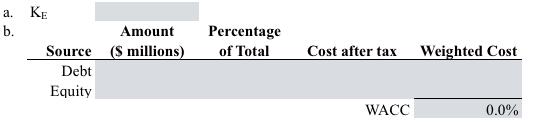

a. Estimate Montego’s cost of equity capital.

b. Estimate Montego’s weighted-average cost of capital. Prepare a table showing the relevant variables.

Facts and Assumptions Yield to maturity on long-term government bonds Yield to maturity on company long-term bonds Coupon rate on company long-term bonds Market price of risk, or risk premium Estimated company equity beta Stock price per share Number of shares outstanding (million) Book value of equity (million) Book value of interest-bearing debt (million) Tax rate 4.54% 6.32% 7.50% 6.30% 1.05 $25.97 681.2 $4,965 $6,674 35.0%

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

To answer these questions well need to perform some financial calculations based on the given data a Estimate Montegos cost of equity capital Ke We ca... View full answer

Get step-by-step solutions from verified subject matter experts