A bank owns a portfolio of bonds whose value P(r) depends on the interest rate r (measured

Question:

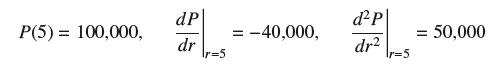

A bank owns a portfolio of bonds whose value P(r) depends on the interest rate r (measured in percent; e.g., r = 5 means a 5% interest rate). The bank’s quantitative analyst determines that

In finance, this second derivative is called bond convexity. Find the second Taylor polynomial of P(r) centered at r = 5 and use it to estimate the value of the portfolio if the interest rate moves to r = 5.5%.

Transcribed Image Text:

P(5) = 100,000, dP dr r=5 = -40,000, d²p| dr² = 50,000 =

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

The second Taylor polynomial of Pr at r 5 is Tr P5 P5r 5 P 5 ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Mathematics questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Ann Carter, Chief Financial Officer of Consolidated Electric Company (Con El), must make a recommendation to Con Els board of directors regarding the firms dividend policy. Con El owns two...

-

The population of a culture of yeast cells is studied in the laboratory to see the effects of limited resources (food, space) on population growth. At 2-h intervals, the size of the population...

-

If two companies in the same industry use different methods to value inventory, this makes comparisons more difficult but not impossible. a. True b. False 2. An increase in a company's revenue and...

-

Chris Spear invested $15,000 today in a fund that earns 8% compounded annually. To what amount will the investment grow in 3 years? To what amount would the investment grow in 3 years if the fund...

-

What is a closeness rating and how can computer analysis support layout decisions?

-

A \(100-\mathrm{mm}\)-long metal rod is placed in a uniform magnetic field with the rod length perpendicular to the field direction (Figure P29.26). The rod moves at \(0.20 \mathrm{~m} /...

-

The beginning inventory for Francesca Co and data on purchases and sales for a three-month period are shown in Problem 7-1B. Instructions 1. Record the inventory, purchases, and cost of merchandise...

-

Part A A string that is 9.6 m long is tied between two posts and plucked. The string produces a wave that has a frequency of 320 Hz and travels with a speed of 192 m/s. How many full wavelengths of...

-

Give an example of conditionally convergent series converges absolutely. an and bn such that (an + bn) + n=1 = | n=1

-

A ball dropped from a height of 10 ft begins to bounce vertically. Each time it strikes the ground, it returns to two-thirds of its previous height. What is the total vertical distance traveled by...

-

Russell/Mellon is a leading provider of investment information services to more than 3,000 institutional investors such as pension funds, asset managers, and consultants. This company is able to...

-

Consider a production function and the resource constraint Y = F(K, Lt) = AKO L and the capital accumulation equation Y = C + I + G e G = K Assume there is no population growth, so L = Lt+1= L (2)...

-

Define an S-Corp. What are the advantages and disadvantages of it? What kind of business would this legal form of organization best appeal to?

-

jelle puts 1200 at the end of every year into Ira that averages 5% interest compounded annually. how much be be in the account when she retires after 35 years of investing

-

In mechanics, material properties are established based on the logic of relating deformations to externally applied forces. Depending on the properties of interest, various ways of applying external...

-

Two investors, A and B, trade the stock TWTR. Each investor maximizes his expected future wealth subject to a penalty for risk (as discussed in Chapter 5). Investor A's optimal position measured i...

-

Use the seasonal indexes computed to deseasonalize the data in Problem 15.32. in Problem 15.32. Chemicals and Allied Products Time Period ($ billion) January (year 5) ........28.931 February...

-

Reconsider Prob. 1474. In order to drain the tank faster, a pump is installed near the tank exit as in Fig. P1475. Determine how much pump power input is necessary to establish an average water...

-

Determine the interval(s) on which the following functions are continuous; then analyze the given limits. f(x) = csc x; lim f(x); lim_f(x) >/4' >2

-

Determine the interval(s) on which the following functions are continuous; then analyze the given limits.

-

Determine the interval(s) on which the following functions are continuous; then analyze the given limits. 1 + sin x f(x) lim_ f(x); lim f(x) /2 4/3 cos x

-

In 1991, Geoffrey A. Moore, a lecturer and management consultant, wrote an influential book titled Crossing the I Chasm. The book became an instant must-read for managers, entrepreneurs, and...

-

Understand the table 12 and its impact on answers. Supporting document 5 is below: Understand the table detached from the health and safety executive site HSE UK. Noise and health surveillance 4 (a)...

-

Answer 2,3,4 questions. Don't give me a Question 1 answer. I need 2,3,4 questions answer. For the QFD Problem 4 Matrix, compute the (1) Customer requirements absolute weight. (2) Technical...

Study smarter with the SolutionInn App