Question: The minimum EUAC value of the challenger is ? The marginal cost of keeping the defender in service for one more year is ? A

The minimum EUAC value of the challenger is ?

The marginal cost of keeping the defender in service for one more year is ?

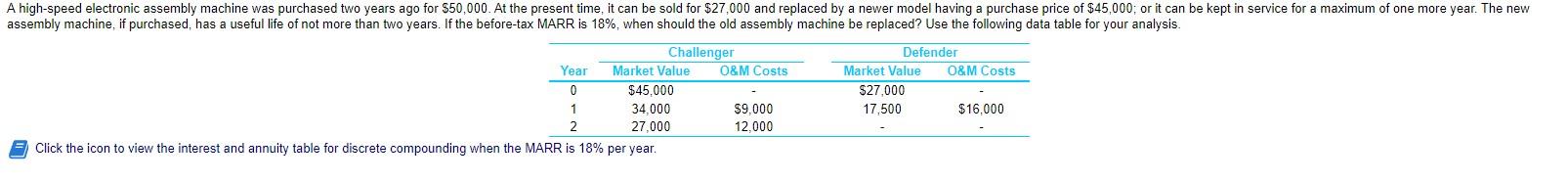

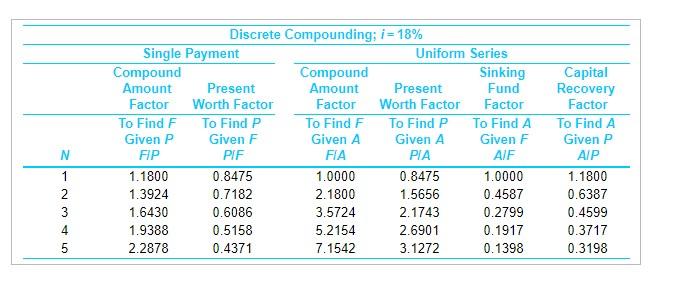

A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $27,000 and replaced by a newer model having a purchase price of $45,000; or it can be kept in service for a maximum of one more year. The new assembly machine, if purchased, has a useful life of not more than two years. If the before-tax MARR is 18%, when should the old assembly machine be replaced? Use the following data table for your analysis. Challenger Defender Year 0 1 2 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 18% per year. Market Value $45,000 34,000 27,000 O&M Costs $9,000 12,000 Market Value $27,000 17,500 O&M Costs $16,000

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

ANSWER To determine when the old assembly machine should be replaced we need to compare the equivale... View full answer

Get step-by-step solutions from verified subject matter experts