Question: Compare the Ultra Cable market value with its book value. Is the book value a good representation of the Ultra Cable??s true condition? Explain your

Compare the Ultra Cable market value with its book value. Is the book value a good representation of the Ultra Cable??s true condition? Explain your answer

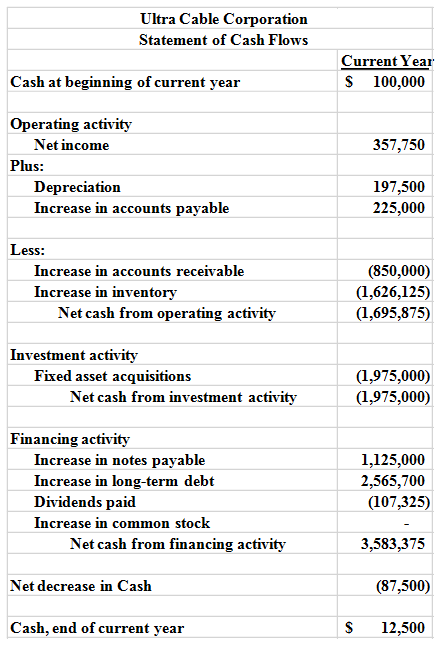

Ultra Cable Corporation Statement of Cash Flows Current Year $ 100,000 Cash at beginning of current year Operating activity Net income 357,750 Plus: Depreciation Increase in accounts payable 197,500 225,000 Less: Increase in accounts receivable (850,000) (1,626,125) (1,695,875) Increase in inventory Net cash from operating activity Investment activity Fixed asset acquisitions Net cash from investment activity (1,975,000) (1,975,000) Financing activity Increase in notes payable Increase in long-term debt 1,125,000 2,565,700 (107,325) Dividends paid Increase in common stock Net cash from financing activity 3,583,375 Net decrease in Cash (87,500) Cash, end of current year 12,500

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Ultra Cables Current Market Value Current Stock Price 200000 shares 25200000 5000000 Ultra Cables Bo... View full answer

Get step-by-step solutions from verified subject matter experts