Alex Wilson operates On-Time Courier Service. The company has four employees who are paid on an hourly

Question:

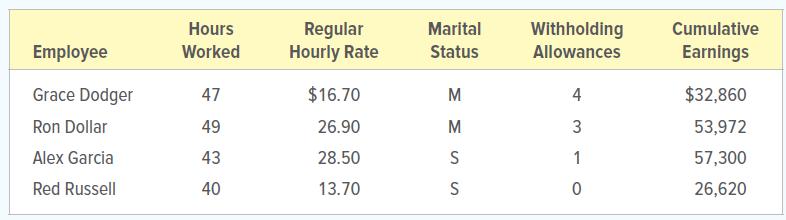

Alex Wilson operates On-Time Courier Service. The company has four employees who are paid on an hourly basis. During the workweek beginning December 15 and ending December 21, 20X1, employees worked the number of hours shown below. Information about their hourly rates, marital status, and withholding allowances also appears below, along with their cumulative earnings for the year prior to the December 15–21 payroll period.

INSTRUCTIONS

1. Enter the basic payroll information for each employee in a payroll register. Record the employee’s name, number of withholding allowances, marital status, total and overtime hours, and regular hourly rate. Consider any hours worked beyond 40 in the week as overtime hours.

2. Compute the regular, overtime, and gross earnings for each employee. Enter the figures in the payroll register.

3. Compute the amount of social security tax to be withheld from each employee’s gross earnings. Assume a 6.2 percent social security rate on the first $132,900 earned by the employee during the year. Enter the figures in the payroll register.

4. Compute the amount of Medicare tax to be withheld from each employee’s gross earnings. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register.

5. Determine the amount of federal income tax to be withheld from each employee’s total earnings. Use the tax tables in Figure 10.2 to determine the withholding for Russell. Withholdings are $112.00 for Dodger, $323.00 for Garcia, and $258 for Dollar. Enter the figures in the payroll register.

6. Compute the net amount due each employee and enter the figures in the payroll register.

7. Total and prove the payroll register. Dodger and Russell are office workers. Garcia and Dollar are delivery workers.

8. Prepare a general journal entry to record the payroll for the week ended December 21, 20X1. Use 32 as the page number for the general journal.

9. Prepare a general journal entry on December 23 to summarize payment of wages for the week.

Analyze:

What percentage of total taxable wages was delivery wages?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina