Certain transactions and procedures relating to federal and state unemployment taxes are given below for Latest Greatest,

Question:

Certain transactions and procedures relating to federal and state unemployment taxes are given below for Latest Greatest, a retail store owned by John Marion. The firm’s address is 4560 LBJ Freeway, Dallas, TX 75232-6002. The firm’s phone number is 972-456-1201. The employer’s federal and state identification numbers are 75-9999999 and 37-6789015, respectively. Carry out the procedures as instructed in each step.

INSTRUCTIONS

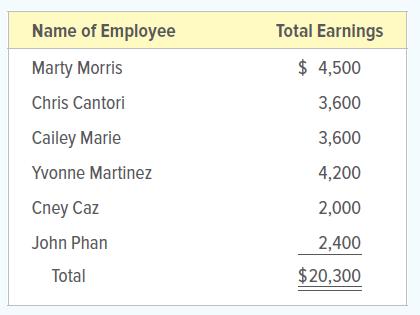

1. Compute the state unemployment insurance tax owed for the quarter ended March 31, 20X1. This information will be shown on the employer’s quarterly report to the state agency that collects SUTA tax. The employer has recorded the tax expense and liability on each payroll date. Although the state charges a 5.4 percent unemployment tax rate, Latest Greatest has received a favorable experience rating and therefore pays only a 2.3 percent state tax rate. The employee earnings for the first quarter are given below. All earnings are subject to SUTA tax.

2. On April 30, 20X1, the firm issued a check for the amount computed above. Record the transaction in general journal form. Use journal page 21.

Analyze:

If Marty Morris made the same amount for the quarter ended June 30, 20X1, how much of his earnings would be subject to the federal unemployment tax?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina