Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company in Problem

Question:

Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company in Problem 12.5A at the end of Chapter 12. Then follow the instructions to complete this problem.

Data from in problem 12.5A

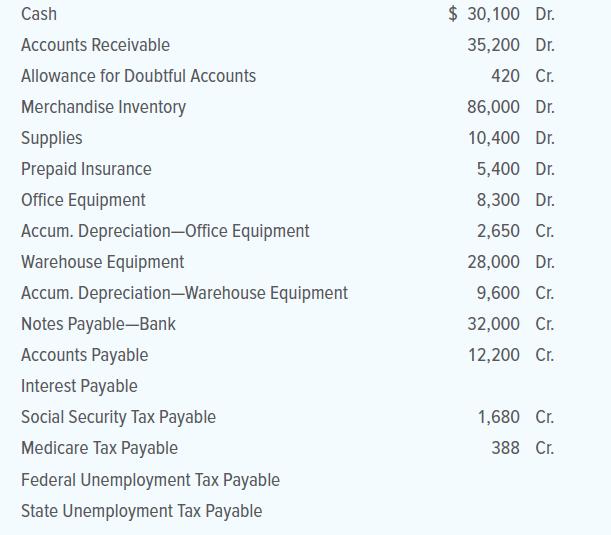

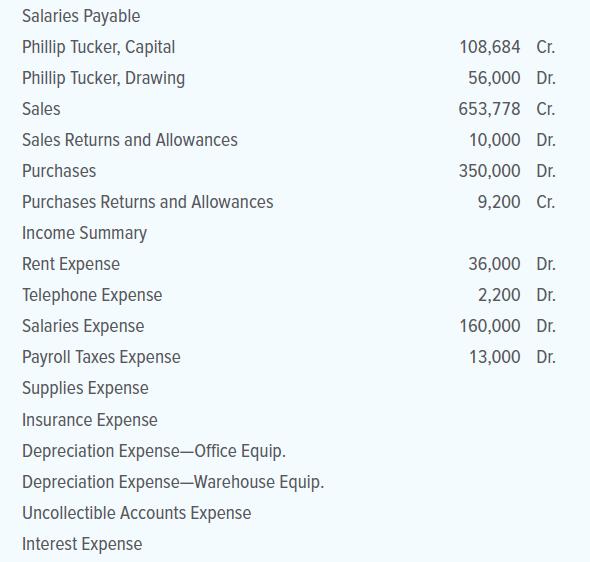

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 20X1, the firm’s general ledger contained the accounts and balances that follow.

ACCOUNTS AND BALANCES

ADJUSTMENTS

a.–b. Merchandise inventory on December 31, 20X1, is $78,000.

c. During 20X1, the firm had net credit sales of $560,000; past experience indicates that 0.5 percent of these sales should result in uncollectible accounts.

d. On December 31, 20X1, an inventory of supplies showed that items costing $1,180 were on hand.

e. On May 1, 20X1, the firm purchased a one-year insurance policy for $5,400.

f. Three years ago the firm purchased office equipment for $8,300. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $350.

g. Three years ago the firm purchased warehouse equipment for $28,000. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,000.

h. On November 1, 20X1, the firm issued a four-month, 12 percent note for $32,000.

i. On December 31, 20X1, the firm owed salaries of $5,000 that will not be paid until 20X2.

j. On December 31, 20X1, the firm owed the employer’s social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,000 of accrued wages.

k. On December 31, 20X1, the firm owed the federal unemployment tax (assume 0.6 percent) and the state unemployment tax (assume 5.4 percent) on the entire $5,000 of accrued wages.

INSTRUCTIONS

1. Record adjusting entries in the general journal as of December 31, 20X1. Use 25 as the first journal page number. Include descriptions for the entries.

2. Record closing entries in the general journal as of December 31, 20X1. Include descriptions.

3. Record reversing entries in the general journal as of January 1, 20X2. Include descriptions.

Analyze:

Assuming that the firm did not record a reversing entry for salaries payable, what entry is required when salaries of $6,000 are paid on January 3?

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina