Sports Junction began operations March 1, 20X1. The firm sells its merchandise for cash; on open account;

Question:

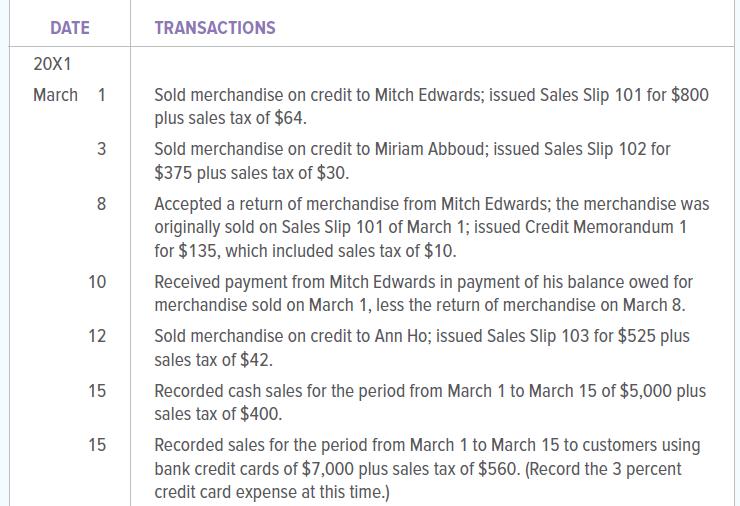

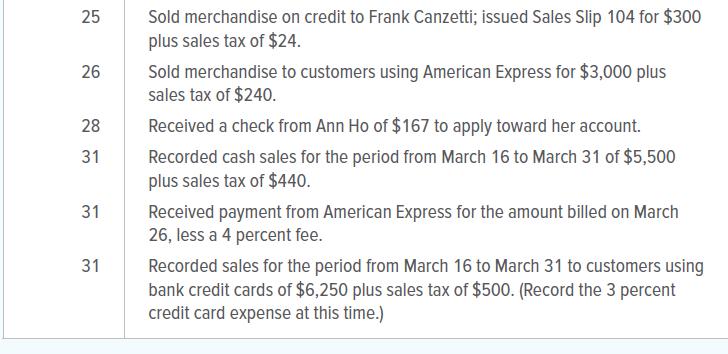

Sports Junction began operations March 1, 20X1. The firm sells its merchandise for cash; on open account; to customers using bank credit cards, such as MasterCard and Visa; and to customers using American Express. Merchandise sales are subject to an 8 percent sales tax. The bank credit cards charge a 3 percent fee. American Express charges a 4 percent fee. During March, Sports Junction engaged in the following transactions:

INSTRUCTIONS

1. Open the general ledger account and accounts receivable ledger accounts indicated below.

2. Record the transactions in a general journal. Use 1 as the journal page number.

3. Post the entries from the general journal to the appropriate account in the general ledger and in the accounts receivable ledger.

4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

GENERAL LEDGER ACCOUNTS

111 Accounts Receivable

ACCOUNTS RECEIVABLE LEDGER ACCOUNTS

Step by Step Answer:

College Accounting A Contemporary Approach

ISBN: 9781260780352

5th Edition

Authors: David Haddock, John Price, Michael Farina