Fill in the blanks with the correct terms from the list below 1. Codes used to determine

Question:

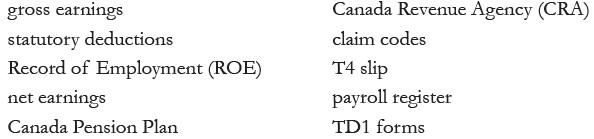

Fill in the blanks with the correct terms from the list below

1. Codes used to determine the amount of federal and provincial income taxes to be withheld from earnings are called __________________.

2. ______________ refers to gross earnings minus all deductions for the period.

3. ______________ refers to earnings before any deductions are taken.

4. Forms completed by an employee upon start of their employment that set out the deductions claimed by the employee are called ________________.

5. Amounts that are required by law to be withheld from earnings are called _______________.

6. A _______________ is prepared once a year to each employee to show earnings and deductions.

7. The _____________ is the body that oversees the collections of income tax as well as CPP and EI.

8. A _______________ lists in considerable detail the income, deductions, net pay, and other information for each employee for a given pay period.

9. The deduction for _______________ takes into consideration a $3,500 yearly deduction before a calculation is made for net pay.

10. A _________________ is a special form to be completed for each employee at the end of his or her employment.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 9780135222416

14th Canadian Edition

Authors: Jeffrey Slater, Debra Good