Question:

Recall the following details about the two employees hired in November.

a. CPP is deducted at 5.10% (considering $3,500 yearly exemption).

b. EI is deducted at 1.62% of gross earnings.

c. Both employees pay income taxes at a rate of 20%.

d. Each employee earns $20 an hour and is paid time-and-a-half for hours worked in excess of 40 weekly.

Assignment

1. Record the transactions listed below in the appropriate journal and post to the general ledger.

2. Prepare a payroll register.

3. Prepare employee earnings records for each of the two employees.

Because it is the end of the calendar year, Tony Freedman knows that, in addition to recording the normal entries for December 2022 above, he will need to complete certain tasks that relate to payroll. Specifically, he will need to prepare T4 slips for his two employees, and then complete the T4 Summary for the year. He will do this in January 2023 to get the T4 slips to his employees and the T4 Summary to the Minister of Finance by the due date of February 28, 2023. Since these forms will be dealt with in January, they do not need to be filled in now.

Transcribed Image Text:

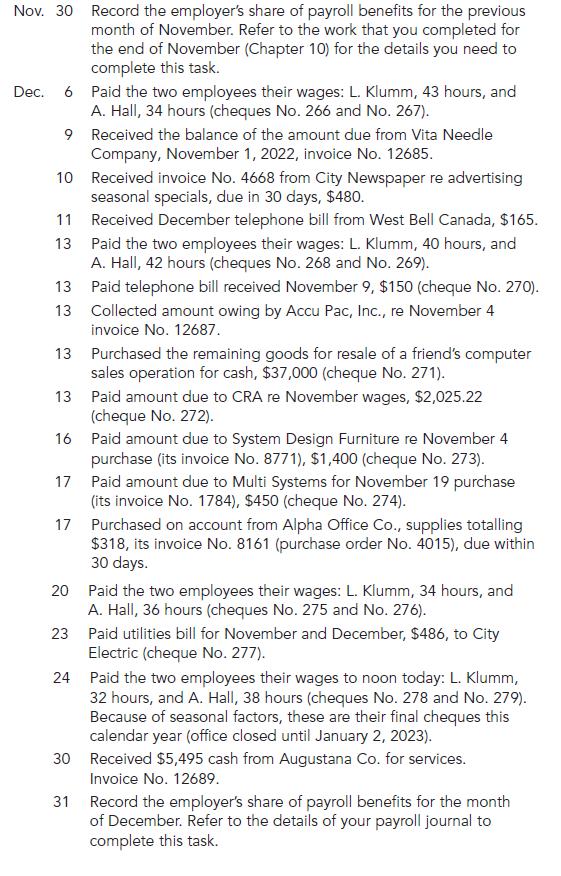

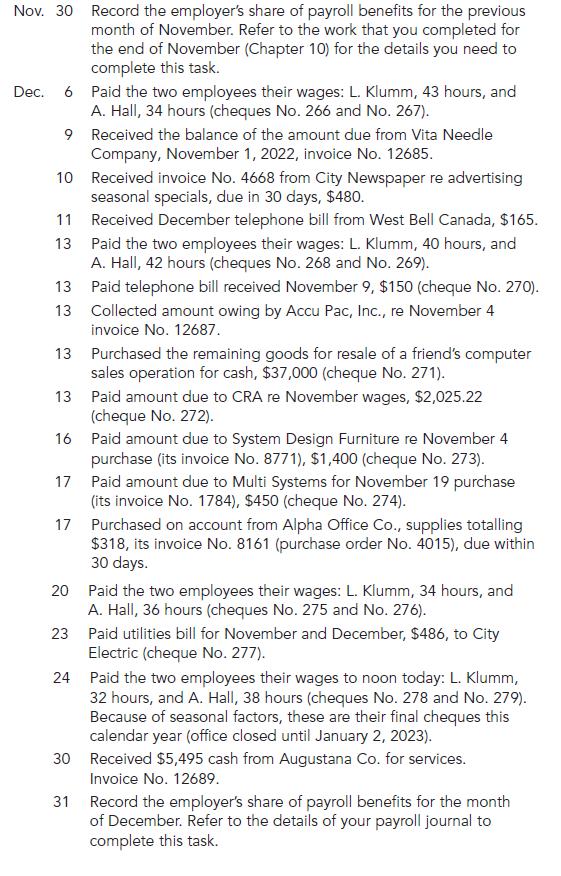

Nov. 30 Record the employer's share of payroll benefits for the previous

month of November. Refer to the work that you completed for

the end of November (Chapter 10) for the details you need to

complete this task.

Dec.

6

Paid the two employees their wages: L. Klumm, 43 hours, and

A. Hall, 34 hours (cheques No. 266 and No. 267).

9

10

11

13

20

Received the balance of the amount due from Vita Needle

Company, November 1, 2022, invoice No. 12685.

23

Received invoice No. 4668 from City Newspaper re advertising

seasonal specials, due in 30 days, $480.

13

13

13

13

Paid amount due to CRA re November wages, $2,025.22

(cheque No. 272).

16

Paid amount due to System Design Furniture re November 4

purchase (its invoice No. 8771), $1,400 (cheque No. 273).

Paid amount due to Multi Systems for November 19 purchase

(its invoice No. 1784), $450 (cheque No. 274).

17

17

Received December telephone bill from West Bell Canada, $165.

Paid the two employees their wages: L. Klumm, 40 hours, and

A. Hall, 42 hours (cheques No. 268 and No. 269).

Paid telephone bill received November 9, $150 (cheque No. 270).

Collected amount owing by Accu Pac, Inc., re November 4

invoice No. 12687.

Purchased the remaining goods for resale of a friend's computer

sales operation for cash, $37,000 (cheque No. 271).

Purchased on account from Alpha Office Co., supplies totalling

$318, its invoice No. 8161 (purchase order No. 4015), due within

30 days.

Paid the two employees their wages: L. Klumm, 34 hours, and

A. Hall, 36 hours (cheques No. 275 and No. 276).

Paid utilities bill for November and December, $486, to City

Electric (cheque No. 277).

24 Paid the two employees their wages to noon today: L. Klumm,

32 hours, and A. Hall, 38 hours (cheques No. 278 and No. 279).

Because of seasonal factors, these are their final cheques this

calendar year (office closed until January 2, 2023).

Received $5,495 cash from Augustana Co. for services.

Invoice No. 12689.

30

31

Record the employer's share of payroll benefits for the month

of December. Refer to the details of your payroll journal to

complete this task.