Question: The following is the Paid-In Capital section of stockholders equity for the Royce Corporation on June 1, 202X: The following transactions occurred in the months

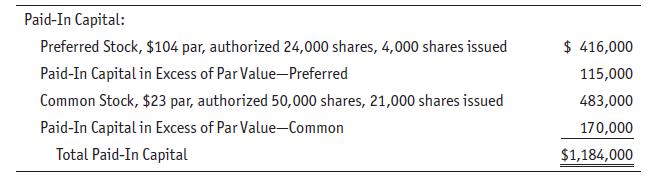

The following is the Paid-In Capital section of stockholders’ equity for the Royce Corporation on June 1, 202X:

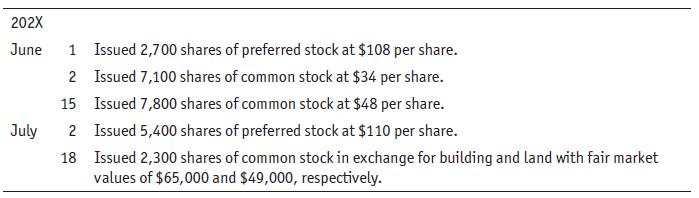

The following transactions occurred in the months of June and July:

1. Journalize the entries and update the stockholders’ equity ledger.

2. Prepare a new Paid-In Capital section of stockholders’ equity as of July 31,

202X.

Paid-In Capital: Preferred Stock, $104 par, authorized 24,000 shares, 4,000 shares issued Paid-In Capital in Excess of Par Value-Preferred Common Stock, $23 par, authorized 50,000 shares, 21,000 shares issued Paid-In Capital in Excess of Par Value-Common Total Paid-In Capital $ 416,000 115,000 483,000 170,000 $1,184,000

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

1 2 Date 202X Jun Jul 1 Cash Account Titles and Description 2 Cash ... View full answer

Get step-by-step solutions from verified subject matter experts