Question: Computing net income from equity analysis, preparing a balance sheet, and computing the debt ratio The accounting records of Tama Co. show the following assets

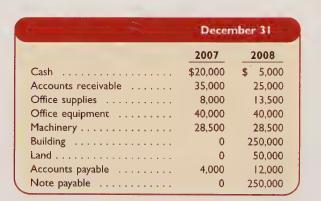

Computing net income from equity analysis, preparing a balance sheet, and computing the debt ratio The accounting records of Tama Co. show the following assets and liabilities as of December 31, 2007, and 2008.

Late in December 2008, the business purchased a small office building and land for \($300,000\). It paid \($50,000\) cash toward the purchase and a \($250,000\) note payable was signed for the balance. J. Tama, the owner, had to invest an additional \($15,000\) cash to enable it to pay the \($50,000\) cash. The owner withdraws \($250\) cash per month for personal use.

Required

1. Prepare balance sheets for the business as of December 31, 2007, and 2008. (Remember that total equity equals the difference between assets and liabilities.)

2. By comparing equity amounts from the balance sheets each year and using the additional information presented in the problem, prepare a calculation to show how much net income was earned by the business during 2008.

3. Prepare its income statement for the year ended December 31, 2008, using the following ending balances for revenues and expenses: Consulting revenue of \($46,000\); Rental revenue of \($3,000\): Rent expense of \($19,000;\) Wages expense of \($14,300\); Utilities expense of \($3,200;\) and Miscellaneous expenses of \($2,000.\)

December 31 2007 2008 Cash Accounts receivable Office supplies Office equipment $20,000 $ 5,000 35,000 25,000 8,000 13,500 40,000 40,000 Machinery 28,500 28,500 Building 0 250,000 Land 0 50,000 Accounts payable 4,000 12,000 Note payable 0 250,000

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts