Knox Corp. has been authorized to issue 10,000 shares of 10 percent noncumulative, nonparticipating preferred stock with

Question:

INSTRUCTIONS

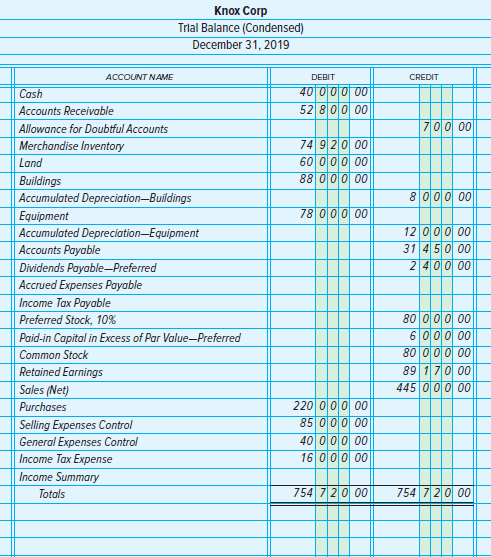

1. Enter the December 31 trial balance on an eight-column worksheet. Provide four lines for the Selling Expenses control account and three lines for the General Expenses control account. Total and rule the Trial Balance columns.

2. Enter the necessary adjustments on the worksheet, based on the following data for December 31:

a. Ending merchandise inventory is $78,000. Close the beginning inventory and set up the ending inventory.

b. Allowance for Doubtful Accounts should be adjusted to a balance of $1,300 (debit Selling Expenses).

c. Depreciation of buildings is $4,000 ($3,600 is selling expense; $400 is general expense).

d. Depreciation of equipment is $6,000 ($2,000 is selling expense; $4,000 is general expense).

e. Accrued expenses are $3,800 ($1,200 is selling expense; $2,600 is general expense).

f. The $16,000 balance in Income Tax Expense represents the quarterly tax deposits. Adjust the Income Tax Expense account using the following procedure:

(1) Extend the adjusted income and expense items to the Income Statement columns. Using this data, compute the net income before income taxes. (2) Assuming that taxable income is the same as net income before income taxes, use the tax rates given in this chapter to compute the federal income tax. Round the computed tax to the nearest whole dollar. Ignore state and local income taxes.

3. Complete the worksheet as shown in the text.

4. Prepare a condensed income statement for the year.

5. Prepare a balance sheet as of December 31, 2019. The balance of Retained Earnings on January 1, 2019, was $89,170. The only dividends declared during the year were dividends on preferred stock.

6. Journalize the adjusting and closing entries on December 31, 2019. Descriptions are not required.

Analyze: Assume that dividends were declared in equal amounts over the four quarters of fiscal 2019. What percentage of Knox Corp.€™s annual income before tax was spent on dividends to stockholders?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina