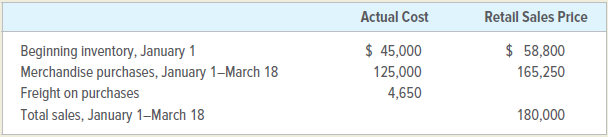

One of Wells Companys retail outlets was destroyed by fire on March 18. All merchandise was burned.

Question:

INSTRUCTIONS

Determine the approximate cost of the inventory destroyed on March 18.

Analyze: Based on the cost you have computed for merchandise inventory, calculate the cost of goods sold for the period.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Question Posted: