Question: Several source documents from RJs Tax Services are presented below. Additional information is as follows. a. The PMT on September 29 was a loan payment

Several source documents from RJ’s Tax Services are presented below. Additional information is as follows.

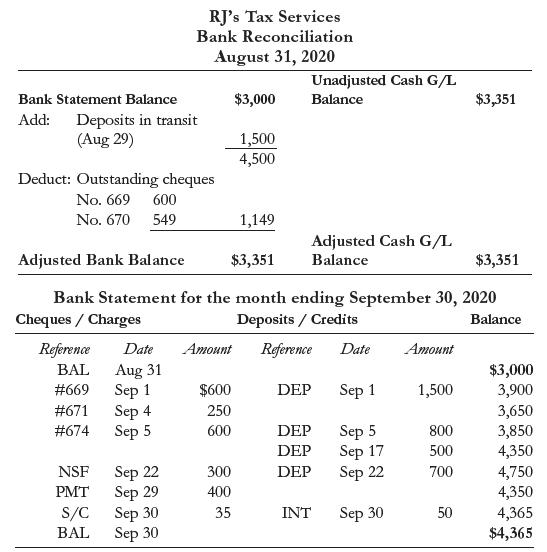

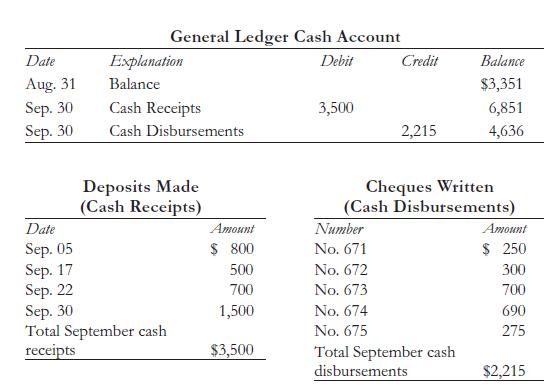

a. The PMT on September 29 was a loan payment taken out of RJ’s Tax Services account in error due to a bank clerk’s mistake.

b. Cheque No. 674 was a payment for insurance to B. Brubacher Brokers. The bookkeeper recorded it as $690 in error.

c. The NSF cheque was in payment of an accounts receivable balance owed by Vinny Vanelswyk.

Required

Prepare the bank reconciliation at September 30, 2020, as well as the necessary journal entries for RJ’s Tax Services.

RJ's Tax Services Bank Reconciliation August 31, 2020 Unadjusted Cash G/L Bank Statement Balance $3,000 Balance $3,351 Deposits in transit (Aug 29) Add: 1,500 4,500 Deduct: Outstanding cheques No. 669 600 No. 670 549 1,149 Adjusted Cash G/L Adjusted Bank Balance $3,351 Balance $3,351 Bank Statement for the month ending September 30, 2020 Deposits / Credits Cheques / Charges Balance Reference Date Amount Reference Date Amount Aug 31 Sep 1 Sep 4 Sep 5 BAL $3,000 3,900 3,650 3,850 4,350 4,750 4,350 #669 $600 DEP Sep 1 1,500 #671 250 DEP Sep 5 Sep 17 Sep 22 #674 600 800 DEP 500 Sep 22 Sep 29 Sep 30 Sep 30 NSF 300 DEP 700 PMT 400 S/C 35 INT Sep 30 50 4,365 $4,365 BAL

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Book Balance Add Interest earned On bank account Error on Chq 674 Deduct NS... View full answer

Get step-by-step solutions from verified subject matter experts