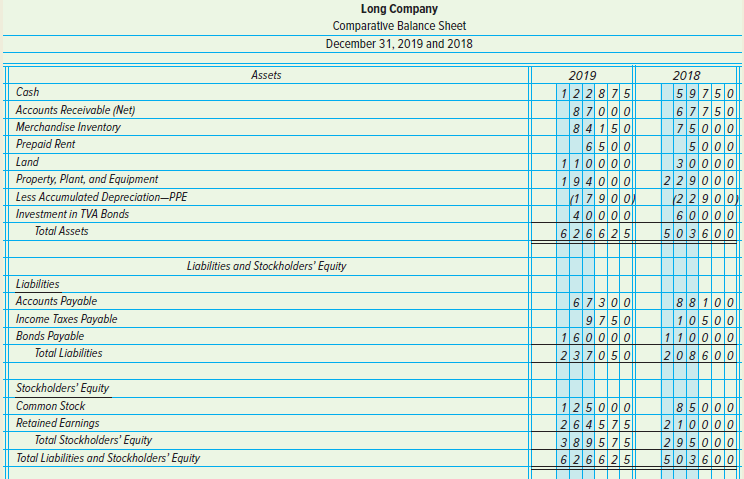

The comparative balance sheet for Long Company as of December 31, 2019 and 2018, is shown below,

Question:

INSTRUCTIONS

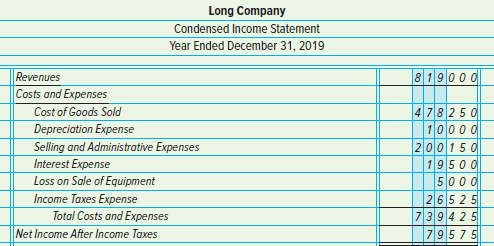

Prepare a statement of cash flows for 2019. Additional information for the year follows:

a. Acquired land at a cost of $80,000; paid one-half of the purchase price in cash and issued common stock for the balance.

b. Sold used equipment for $30,000 in cash. The original cost was $50,000; depreciation of $15,000 had been taken. The remaining change in the Property, Plant, and Equipment account represents a purchase of equipment for cash. Total depreciation expense for the year was $10,000.

c. Issued bonds payable at par value for cash.

d. Sold bond investments costing $20,000 at no gain or loss during the year.

e. Paid $25,000 in cash dividends on the common stock.

Analyze: By what percentage did Cash increase from January 1 to December 31?

Par ValuePar value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina