To: Peter GeorgeFrom: Anthony HoangRe: Accounting ProceduresPlease prepare from the following information for Eco Document Disposal Company

Question:

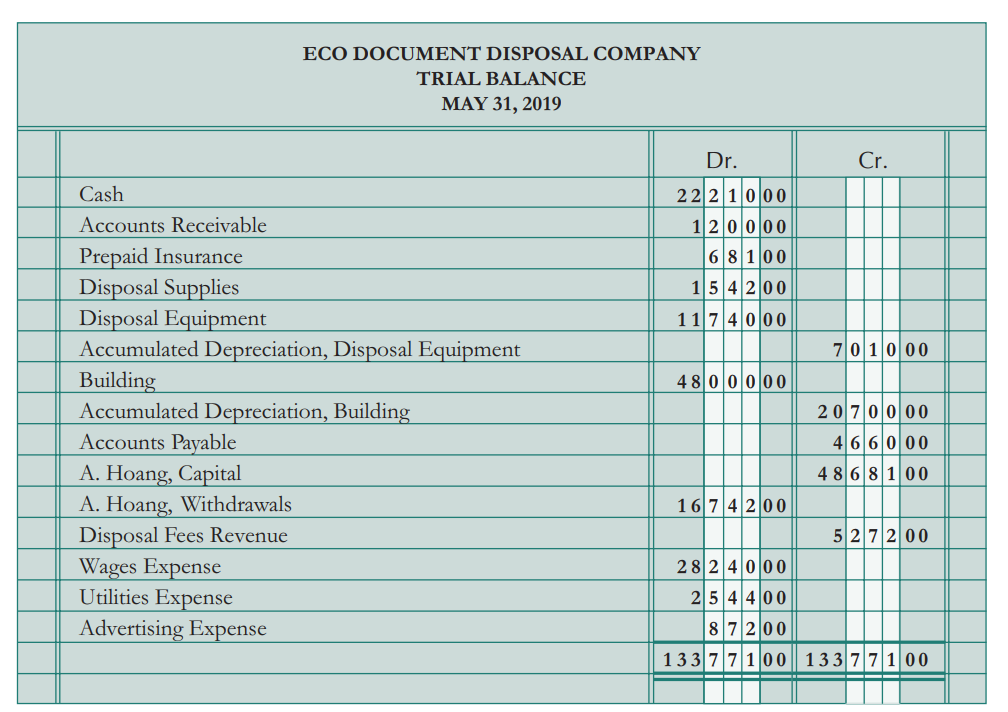

To: Peter GeorgeFrom: Anthony HoangRe: Accounting ProceduresPlease prepare from the following information for Eco Document Disposal Company (attached), (1) a worksheet, along with (2) journalized adjusting entries for the year ending May 31, 2019.

Adjustment Dataa.?Insurance expired, $510.75b.?Disposal supplies on hand, $723c.?Depreciation for the year on disposal equipment is based on the straight-linemethod, 12-year life, and a residual value of $1,225.d.?Depreciation for the year on building is also straight-line, 20-year life, and aresidual value of $25,000e.?Wages earned by employees but not due to be paid until June amounted to36 hours at $18/hour plus 30 hours at $24/hour.

Step by Step Answer:

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good