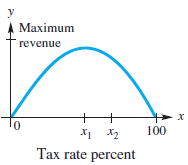

Economist Arthur Laffer has been a center of controversy because of his Laffer curve, an idealized version

Question:

Economist Arthur Laffer has been a center of controversy because of his Laffer curve, an idealized version of which is shown here.

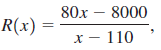

According to this curve, increasing a tax rate, say from x1 percent to x2 percent on the graph, can actually lead to a decrease in government revenue. All economists agree on the endpoints, 0 revenue at tax rates of both 0% and 100%, but there is much disagreement on the location of the rate x1 that produces maximum revenue. Suppose an economist studying the Laffer curve produces the rational function

where R(x) is government revenue in tens of millions of dollars for a tax rate of x percent, with the function valid for 55 ≤ x ≤ 100. Find the revenue for the following tax rates. Round to the nearest tenth if necessary.

(a) 55%

(b) 60%

(c) 70%

(d) 90%

(e) 100%

Step by Step Answer:

College Algebra

ISBN: 978-0134697024

12th edition

Authors: Margaret L. Lial, John Hornsby, David I. Schneider, Callie Daniels