Viking Corporation (a U.S.-based company) has a subsidiary in Japan that imports finished products from unrelated suppliers

Question:

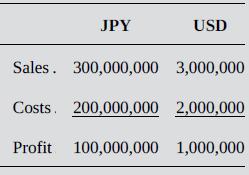

Viking Corporation (a U.S.-based company) has a subsidiary in Japan that imports finished products from unrelated suppliers in China and sells all of its purchases to customers in Japan. Cost of goods sold represents 75 percent of total costs. Budgets in Japanese yen (JPY) and U.S. dollars (USD) using the beginning of period exchange rate of USD 0.010 per JPY 1.00 are as follows:

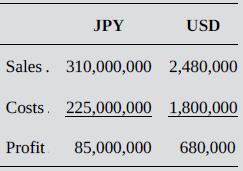

During the budget period, the JPY decreased in value by 20 percent against world currencies, such that the end-of-period exchange rate was USD 0.008 per JPY 1.00. As a result of the increased cost of imports, the manager of the Japanese subsidiary switched to purchasing some of the goods it sells from Japanese manufacturers. Assuming that Viking uses the end-of-period exchange rate to track actual performance, actual results in JPY and USD are as follows:

As a result, there is an unfavorable total budget variance of JPY 15,000,000 and an unfavorable total budget variance of USD 320,000.

Required:

a. Determine the amount of the USD 320,000 unfavorable total budget variance caused by the change in the USD/JPY exchange rate.

b. Taking economic exposure to foreign exchange risk into consideration, estimate what profit would have been (in both JPY and USD) if the Japanese subsidiary’s manager had not taken advantage of the decrease in value of the JPY.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera