You must have completed Exercise 1 in this chapter to complete this exercise. Restore the backup file

Question:

You must have completed Exercise 1 in this chapter to complete this exercise.

Restore the backup file you created in Exercise 1. Change the company name to Boston Catering Ch 6 Ex 5. You will need to create two new payroll items: Salary and Hourly, which both track to a Payroll Expense account.

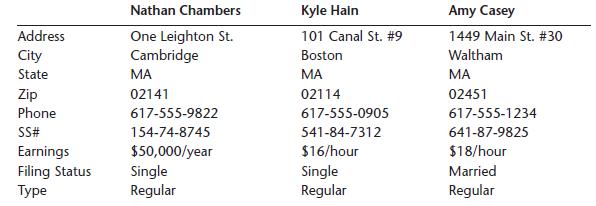

Payroll is paid monthly at the end of the month. All employees are subject to Medicare, Social Security, and Federal unemployment taxes and state unemployment taxes, which are paid quarterly. The company’s state tax ID is 4513-41. All state taxes are paid to the Massachusetts Department of Revenue quarterly. The company’s state unemployment tax rate is 3%. The company is also subject to a workforce training fund tax of .01%. (Note: Use this information even if the QuickBooks Accountant software warns you about account numbers and payees.) Make sure you set up your company file to use manual calculations and then add the following employees:

Data From Exercise 1:

Having just completed your second year of college studying business and accounting, you are looking for summer employment when you run across an ad from a Jessica Gil, a local CPA, who is in need of part-time help. After an hour-long interview, you get the job and are anxious to apply your newfound knowledge in accounting to help a business gain success. Jessica has just taken on a new client, Boston Catering, a catering firm located in Cambridge, Massachusetts, that provides catering services to businesses in the Cambridge and Boston area. So far they have been manually keeping their accounting records but wish to convert to QuickBooks Accountant starting July 1, the beginning of their fiscal year. Jessica would like you to spearhead this effort by creating a QuickBooks Accountant file containing their existing customers, vendors, and employees and then entering their business events in July.

The company’s federal tax ID is 99-2158715 and state tax ID is 4513-41. They are located at 305 Hampshire Street, Cambridge, MA 02139 with a phone number 617-555-2806. The company is organized as a corporation and sells both services and products. They do not sell products online, do charge sales tax of 5% on all items, which is paid to the Massachusetts Department of Revenue, but do not create estimates and do not use sales receipts because all products and services are invoiced. Statements and progress invoices are not used, but they do wish to use QuickBooks Accountant to manage the bills they owe. They do not print checks but do keep track of inventory (change standard inventory account to food inventory) and accept credit cards.

Customers of this catering business are billed a fixed fee, but the company wants to keep track of hourly employees’ hours so they have chosen to track time in QuickBooks Accountant. They will need a chart of accounts and will start using QuickBooks Accountant 7/1/2010.

The company’s existing bank account is with Bank of America in Cambridge. The 6/30/2010 statement reveals an ending balance of $8,345.

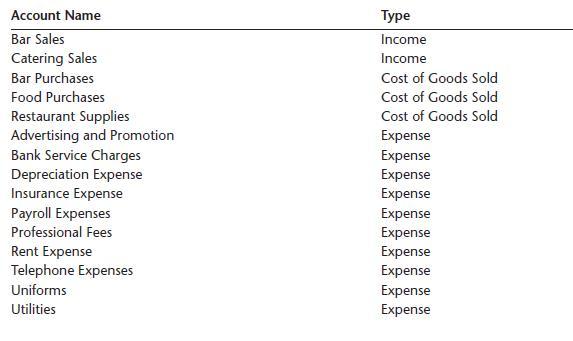

You decide to use the following income and expense accounts:

Any additional accounts already present in your file are to remain as is except for the Inventory Asset account, which should be changed to Food Inventory. You decide to not sign up for an account at intuit.com and to set up preferences exactly as you did in this chapter. Create a new company using QuickBooks Accountant’s EasyStep Interview. Use Boston Catering as the Company Name. The company is in the general service based industry. Each sale is recorded individually, using the U.S. dollar. They have W-2 employees.

Step by Step Answer:

Using QuickBooks Accountant 2018 For Accounting

ISBN: 9780357042083

16th Edition

Authors: Glenn Owen