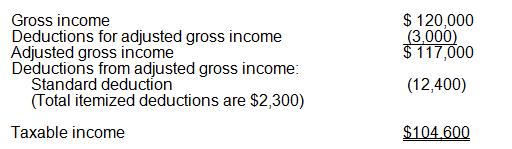

Jasmine's 2021 income tax calculation is as follows: Before filing her return, Jasmine finds an $8,000 deduction

Question:

Jasmine's 2021 income tax calculation is as follows:

Before filing her return, Jasmine finds an $8,000 deduction that she omitted from these calculations. Although the item is clearly deductible, she is unsure whether she should deduct it for or from adjusted gross income. Jasmine doesn't think it matters where she deducts the item, because her taxable income will decrease by $8,000 regardless of how the item is deducted. Is Jasmine correct? Calculate her taxable income both ways. Write a letter to Jasmine explaining any difference in her taxable income arising from whether the $8,000 is deducted for or from adjusted gross income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted: