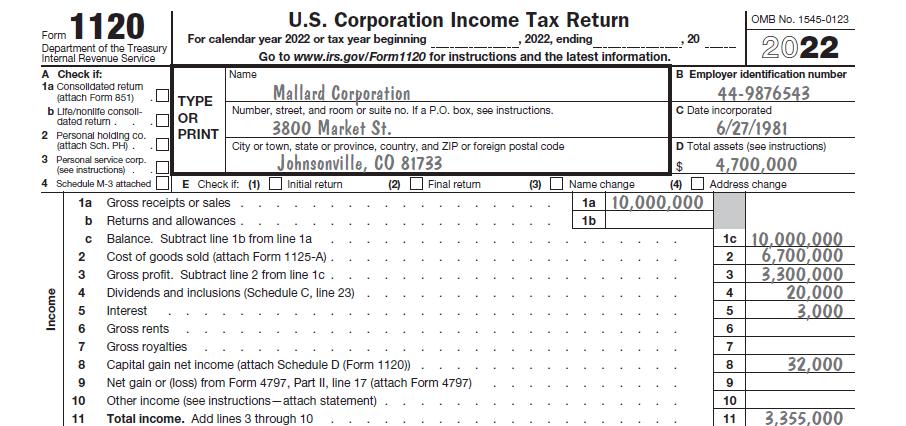

Mallard Corporation is a C corporation and is located at 3800 Market Street, Johnsonville, Colorado 81733. It

Question:

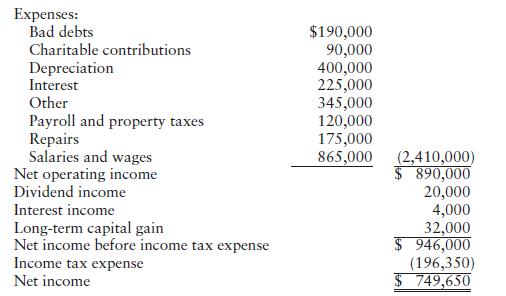

Mallard Corporation is a C corporation and is located at 3800 Market Street, Johnsonville, Colorado 81733. It was incorporated on June 27, 1981, its employer identification number is 44-9876543, and its total assets are \($4.7\) million. Mallard reports its financial accounting net income for 2022 is as follows:

Additional information about Mallard for 2022 is available:

• Bad debt expense for federal income tax purposes (direct write-off method) is \($185,000.

•\) The charitable contributions were cash.

• Depreciation for federal income tax purposes is \($560,000.

•\) \($260,000\) of the salaries and wages are for its officers.

• The dividends were received from domestic corporations. Mallard owns less than 1%

of their stock.

• \($3,000\) of the interest income is taxable, and \($1,000\) of it is tax-exempt.

• A \($60,000\) net operating loss that arose in 2021 is available.

• Mallard made \($160,000\) of timely estimated tax payments for 2022. It wants any overpayment to be credited to its 2023 estimated tax.

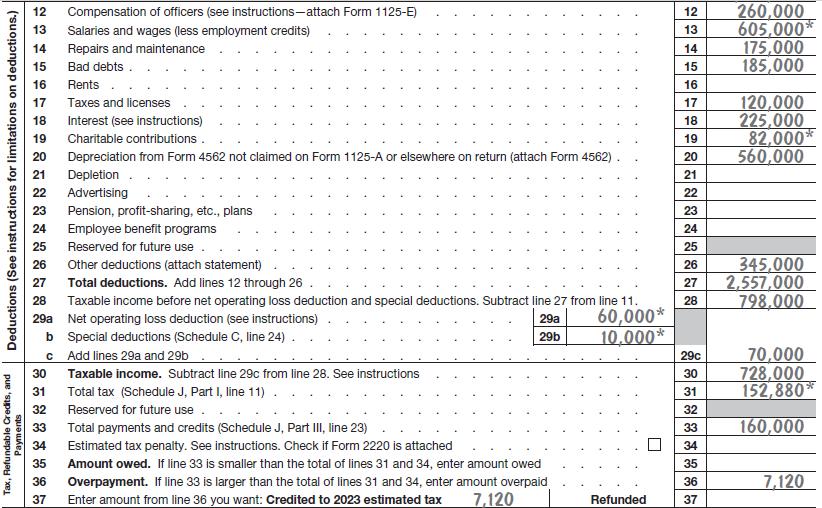

• Unappropriated retained earnings for financial accounting purposes was \($580,000\) at the beginning of 2022.

• Mallard paid \($740,000\) of cash dividends during 2022.

Prepare page 1 of Mallard’s 2022 Form 1120 (U.S. Corporation Income Tax Return), as well as Schedules M-1 and M-2 on page 6.

Data From Form 1120

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson