Paula lives in Arkansas, a state, which imposes a state income tax.During 2018, she pays the following

Question:

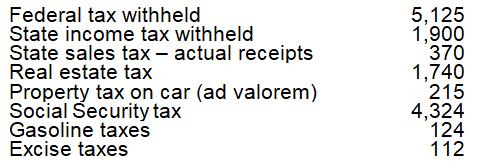

Paula lives in Arkansas, a state, which imposes a state income tax. During 2018, she pays the following taxes:

a. If Paula’s adjusted gross income is $35,000 what is her allowable deduction for taxes?

b. Assume the same facts as in part a, except that Paula pays $1,600 in sales tax on a motor vehicle she purchased during the year. What is Paula’s allowable deduction for taxes?

Transcribed Image Text:

Federal tax withheld State income tax withheld State sales tax - actual receipts Real estate tax Property tax on car (ad valorem) Social Security tax Gasoline taxes Excise taxes 5,125 1,900 370 1,740 215 4,324 124 112

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

a Paula is allowed an itemized deduction for the real estate tax and the property taxes she paid on ...View the full answer

Answered By

Douglas Makokha

Unlock Academic Success with Dedicated Tutoring and Expert Writing Support!

Are you ready to excel in your academics? Look no further! As a passionate tutor, I believe that dedication and hard work are the keys to achieving outstanding results. When it comes to academics, I strive to provide nothing but the best for every student I encounter.

With a relentless thirst for knowledge, I have extensively researched numerous subjects and topics, equipping myself with a treasure trove of answers to tackle any question that comes my way. With four years of invaluable experience, I have mastered the art of unraveling even the most intricate problems. Collaborating with esteemed writers has granted me exclusive access to the trade secrets utilized by the industry's top professionals.

Allow me the pleasure of assisting you with your writing assignments. I thrive on challenges and will guide you through any obstacles you may face. Together, we will unlock your academic potential and pave the way for your success.

4.90+

60+ Reviews

341+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Paula lives in Arkansas, a state, which imposes a state income tax. During 2015, she pays the following taxes: Federal tax withheld ................................. 5,125 State income tax withheld...

-

Paula lives in Arkansas, a state, which imposes a state income tax. During 2021, she pays the following taxes: a. If Paulas adjusted gross income is $35,000 what is her allowable deduction for taxes?...

-

Paula is single and lives in South Carolina, which imposes a state income tax. During 2010, she pays the following taxes: Federal tax withheld .... $5,125 State income tax withheld ... 1,900 State...

-

Use a calculator to evaluate an ordinary annuity formula \[A=m\left[\frac{\left(1+\frac{r}{n}ight)^{n t}-1}{\frac{r}{n}}ight]\] for \(m, r\), and \(t\) (respectively) given in Problems 7-22. Assume...

-

Dexter Company charges to expense all equipment that costs $25 or less. What concept supports this policy?

-

Refer to the Canadian Springs Bottling Department Data Set and your answer to S5-21. Canadian Springs produces premium bottled water. The preceding Short Exercises considered Canadian Springs first...

-

What is the difference between domain definition and domain dictionary? Give an example for each.

-

The adjusted trial balances of Verne Corporation at August 31, 2018, and August 31, 2017, include these amounts (in millions): Verne completed these transactions (in millions) during the year ended...

-

Suppose the spot exchange rate is 0.6993 GBP/CAD. The exchange rate volatility is 20%. Assume that the interest rates in Canada and U.K. are 4.5% and 6%, respectively. What is the price of a...

-

Macon Machines Company began operations on November 1, 2024. The main operating goal of the company is to sell high end robots. Customers may pay using cash or if appropriate, credit is extended to...

-

Determine the maximum deduction from AGI in 2018 for each of the following taxpayers: a. Selen is single and has itemized deductions for the year of $12,200. In addition, Selen's mother lives with...

-

Determine the maximum deduction from AGI in 2018 for each of the following taxpayers: a. Pedro is single and maintains a household for his father. His father is not a dependent of Pedros. Pedros...

-

Apply the Neumann Green function of problem 3.26 to the situation in which the normal electric field is E r = ?E 0 cos ? at the outer surface (r = b) and is E r = 0 on the inner surface (r = a). (a)...

-

Discuss the legal implication of managing change focusing on the redundancy process ?

-

Pure Fiji state How long have they been operational? Where is this company located (headquarters and all its branches) ? Which SM platforms does this company have their presence on? Provide these SM...

-

Explain what approach the efforts will take and explain why the strategy or tactic was considered for the desired outcome for the Latino Community Empowerment Center proposal.

-

Hi I would please need help with this questions - what Project Aristotle found to be most important for team effectiveness. - which is the most important of these factors, and WHY? - How will you use...

-

In a "Short-Paragraph", please respond to the following question,and include a "Source" or "Reference" at the end of your paragraph: Question: How are small businesses capable of providing additional...

-

The private marginal benefit associated with a products consumption is PMB = 360 4Q and the private marginal cost associated with its production is PMC = 6Q. Furthermore, the marginal external...

-

Which of the following is FALSE regarding the purchasing power parity (PPP). a. The PPP is a manifestation of the law of one price b. The PPP says that a country with a higher expected inflation can...

-

Peter is a professor of mathematics at State University. His lifetime avocation has been sailing and he owns an ocean going sailing vessel. He plans to retire in five years and spend the remainder of...

-

Darcy borrowed $4,000 in 2013 from her employer to purchase a new computer. She repays $1,000 of the loan plus 6% interest on the unpaid balance in 2013, 2014, and 2015. After closing a big deal in...

-

Partha owns a qualified annuity that cost $52,000. Under the contract, when he reaches age 65, he will receive $500 per month until he dies. Partha turns 65 on June 1, 2016 and receives his first...

-

Solve the rational equation. - - 6 = 232 = 3/3 4 5

-

What methodologies and frameworks can be utilized to effectively assess task complexity, risk factors, and criticality when delegating responsibilities, ensuring that assignments are aligned with the...

-

Prepare a management briefing that explains the article's key issue or challenge as it is likely to develop over the next three to five years. If necessary, use any or all of the other required...

Study smarter with the SolutionInn App