Marvin and Tracy Peerys 2019 taxable income is $87,830 before considering the effect of their investment activities.

Question:

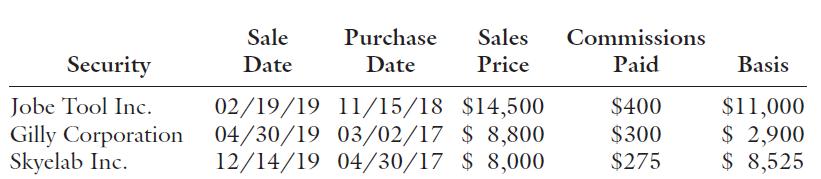

Marvin and Tracy Peery’s 2019 taxable income is $87,830 before considering the effect of their investment activities. The details of their 2019 sales of investment assets follow:

The Form 1099 Marvin and Tracy received from their broker indicated total sales of $30,325 (i.e., sales were reported net of commissions). In addition, on July 19, Marvin sells a Barry Sanders football card for $600. He paid $20 for the card in June 2006.

Marvin and Tracy ask you to prepare their 2019 Schedule D. Their 2018 schedule D indicates that they had a $4,500 net long-term capital loss in 2018. Marvin’s Social Security number is 567-22-3495 and Tracy’s is 654-33-8790. Forms and instructions can be downloaded from the IRS Web site (www.irs.gov).

Step by Step Answer:

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg